Teller

💡 Introduction

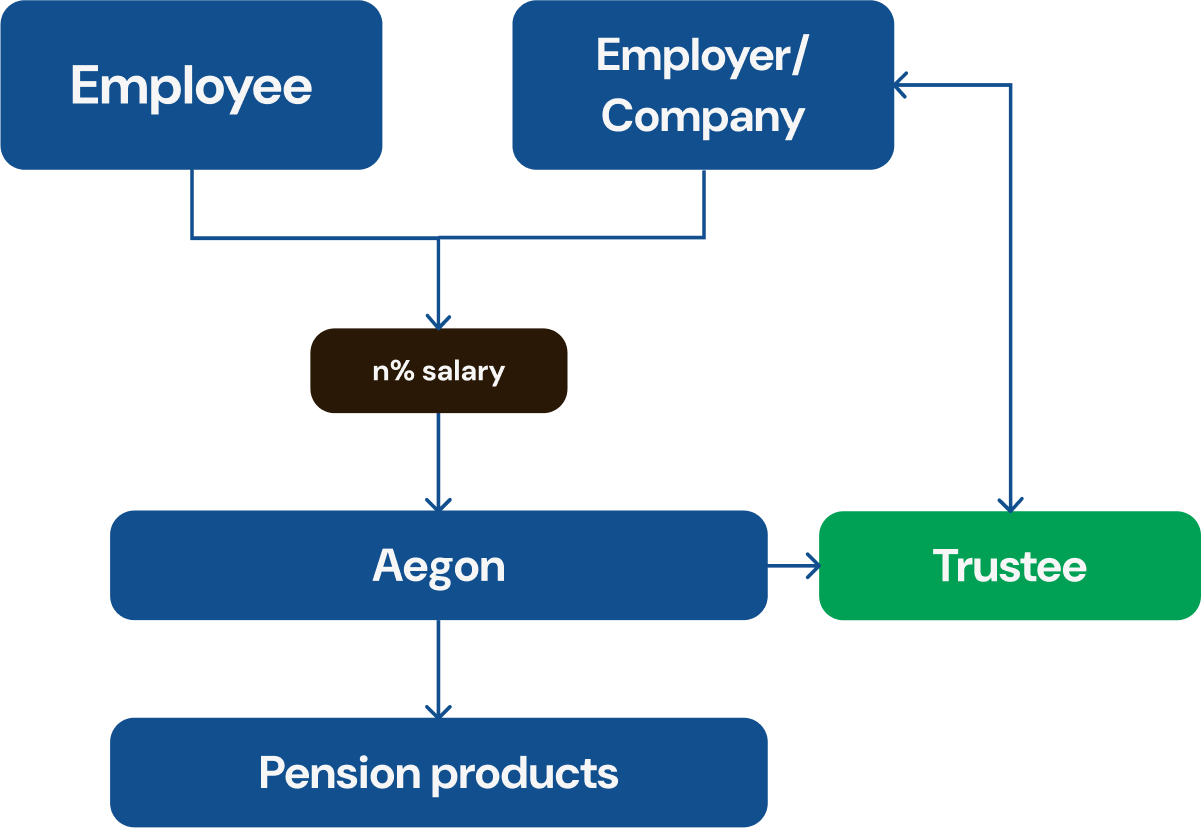

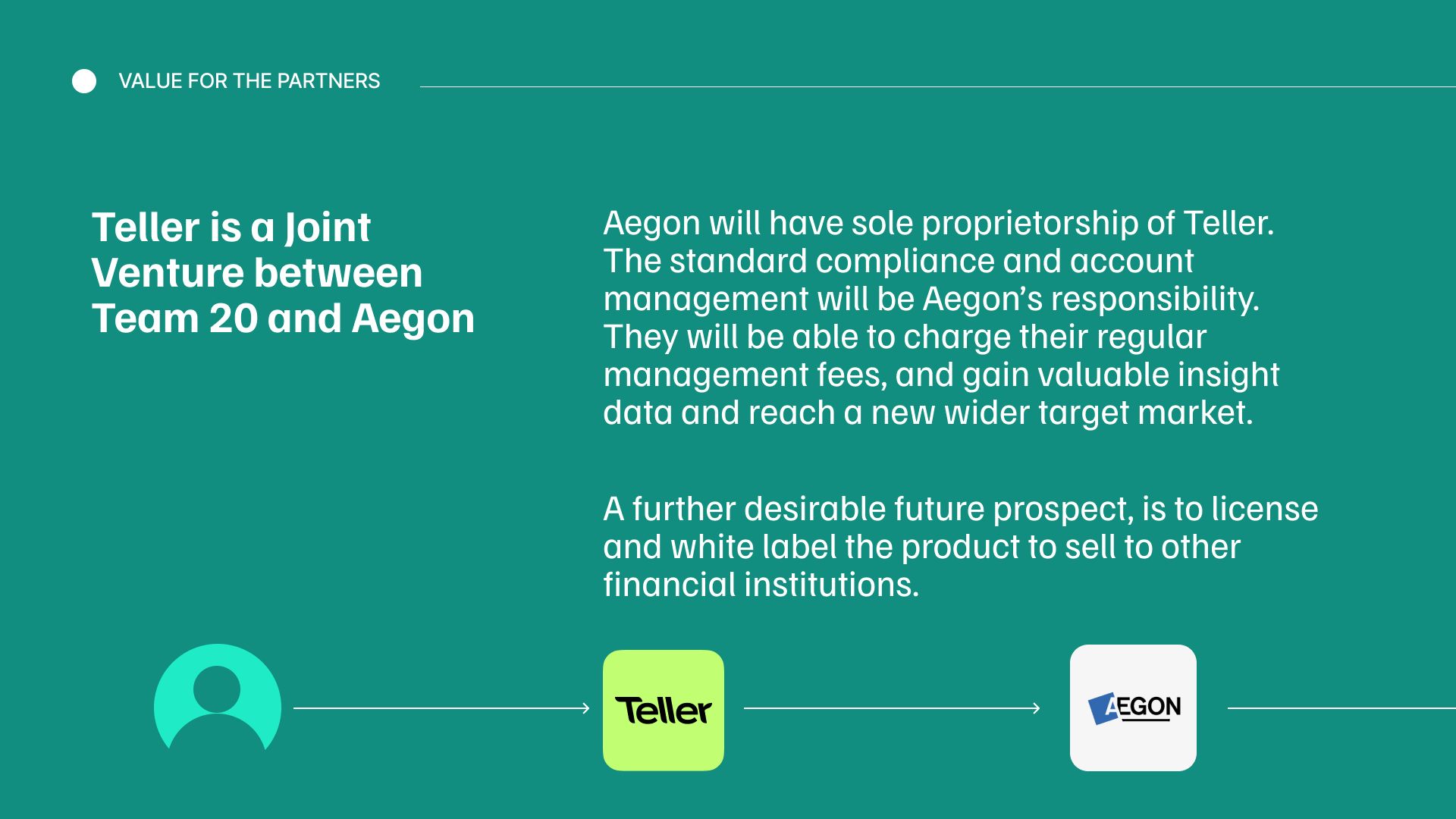

The highlight of Royal College of Art Service Design MA term 1 is the three-month-long comprehensive service design project. Aegon is the pension provider as our collaborator and adviser. They require fresh ideas from us to increase the amount of people engage in pension saving and how to modify this behavior with sustainability.

🗓️ Timeline

2023.10~2024.03

📍 Role

Service designer

🤝 Collaberators

Byoungsam Ko

Joohyun Lee

Marina Stavrinides

Minhee Jeong

🏅 Achievement unlocked

Decoding Global Pension Systems Through Local Insight

By comparing the UK and Taiwan’s pension frameworks, I explored how financial products like "THE pension

companies" shape retirement planning across cultures. Translating complex policy into accessible

knowledge, I helped the team navigate unfamiliar systems with clarity—bridging global finance with

design strategy.

Designing a Human-Centered Cycle of Financial Wellbeing

Through interviews with local residents, I gathered diverse perspectives on saving habits and distilled

them into a practical benefit cycle. This user-informed loop became a foundation for aligning policy

thinking with real-world needs—connecting social insight to actionable design.

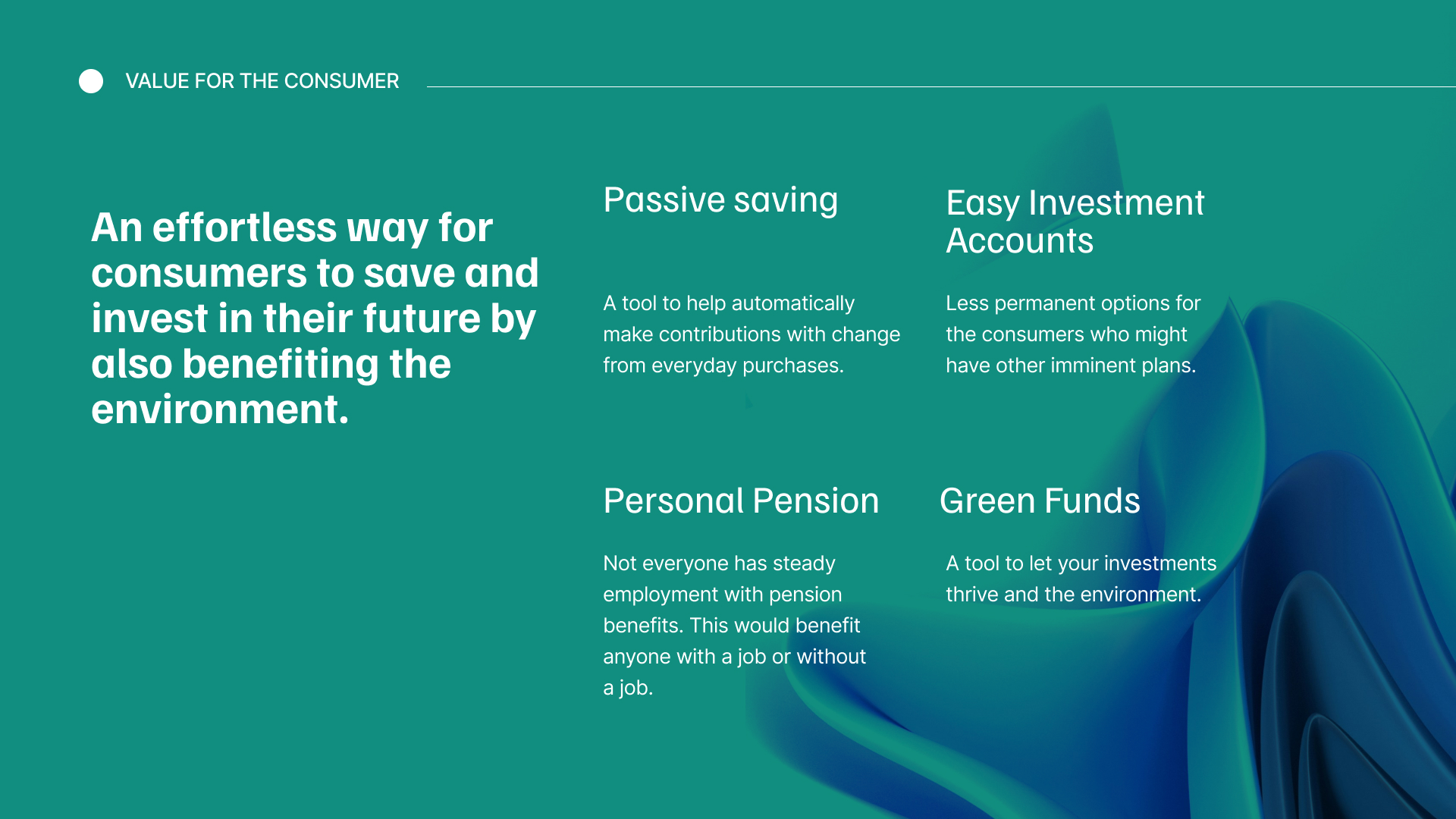

Design target

Increase the withdrawal ratio of pension and invest into green funds through Aegon which not only build up savings but also make the world better.

1. Research

As a Taiwanese, I’m surprise that pension statements are quite different. In the UK, the National pension and workplace pensions are calculated separately. Typically, residents who pay taxes regularly are provided with a dedicated account by the government. Pension generated from National Insurance base on the rate of contribution (similar to Taiwan’s labor pension).

Pension providers not only manage pensions but also offer wealth management service. People can invest in various funds such as the ESG (Environmental, Social, and Governance) financial products through them.

Desk Research

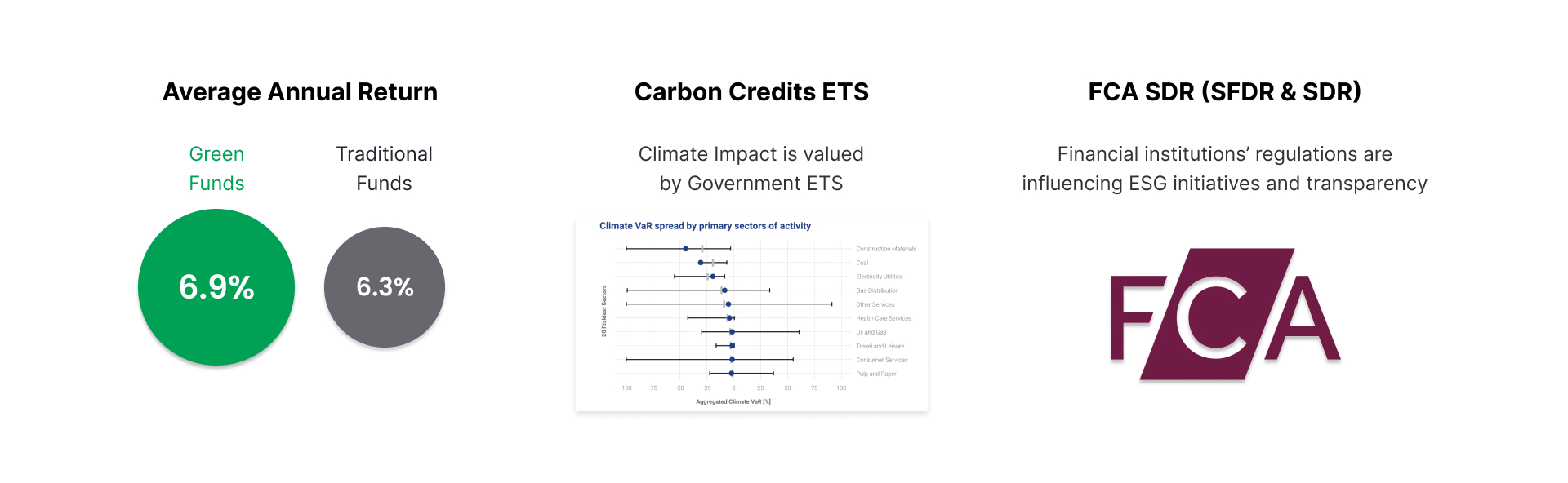

On the policy and economic front, data shows that the returns on green investments now exceed those of traditional investment projects. These investments are regulated for financial transparency by the Financial Conduct Authority (FCA).

Reducing carbon footprints has always been a strategy that nations are committed to improving climate change. Although, carbon credit policies are in starting stage, there will soon be a complete set of measures to restrict industries and people from reducing carbon emissions.

In terms of policies and economics, green funds prove to be more profitable than traditional investments, a fact reinforced by the regular oversight of fiscal transparency by the Financial Conduct Authority (FCA).

Most people know what “sustainable” means but are unsure what to do. They are unable to care about the future arc of the impact of carbon footprint on climate change. Although policies have been introduced one after another, they have never attracted the attention of the general public.

Target User

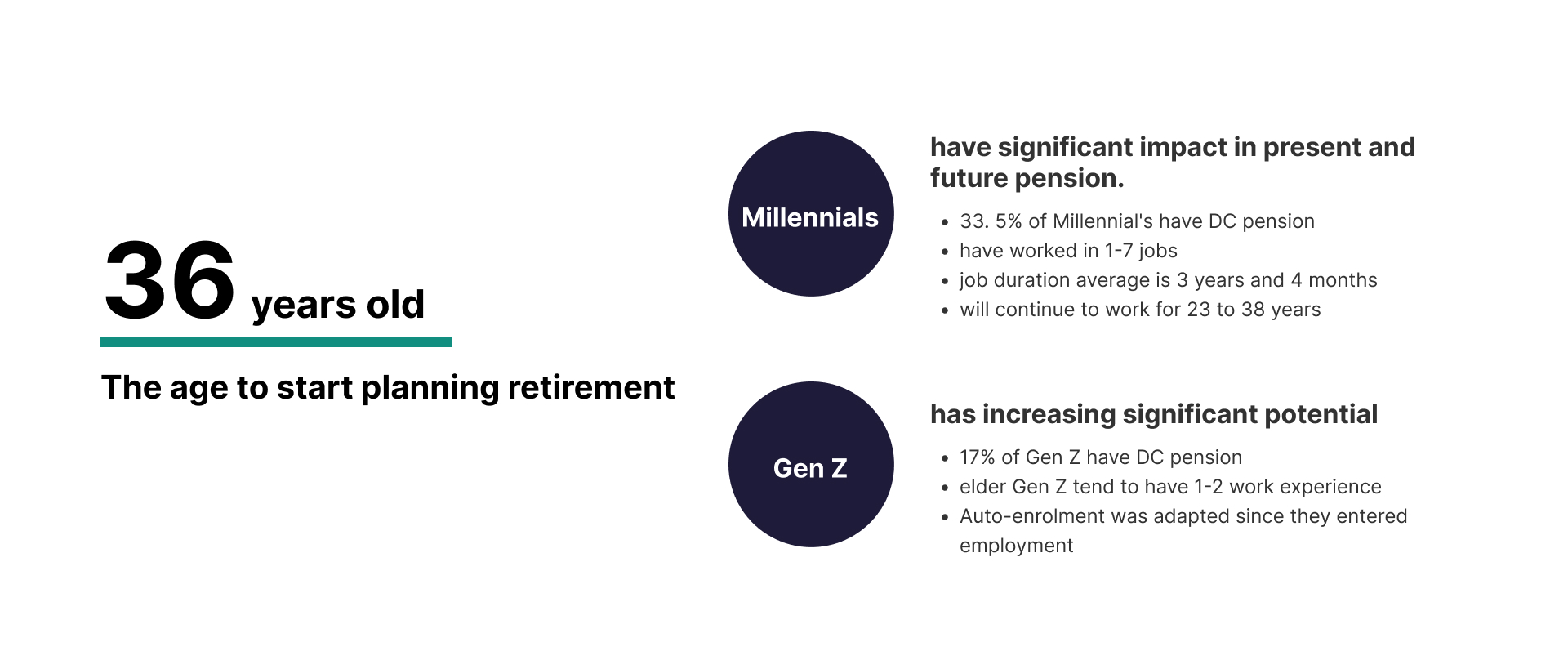

According to data provided by local retirement agencies and insurance companies, people usually start retirement plans at the age of 36 which falls squarely within the category of the Millennial generation (30–39 years old).

Hypothesis

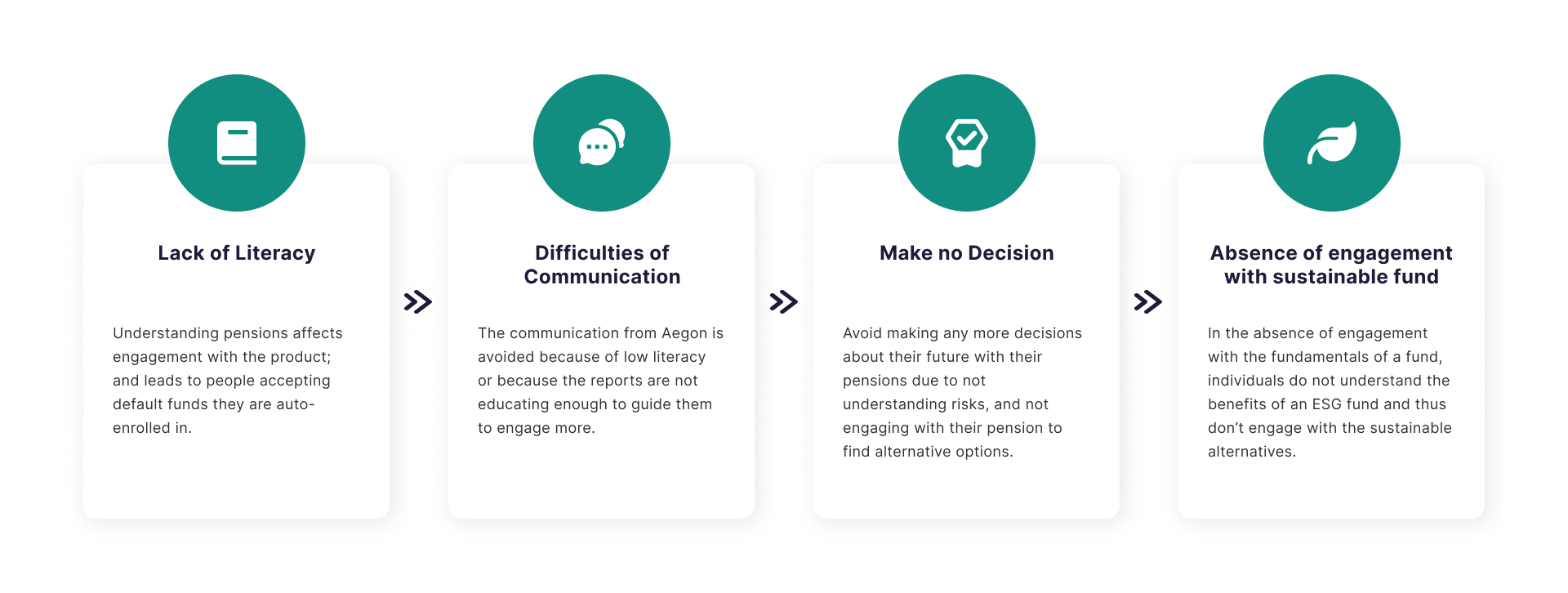

We’ve identified some of the main reasons why people are reluctant to plan for retirement:

Interview

We focused our interviews on high-potential Millennial's, whom research shows are those who have work experience, have retirement accounts and are likely to continue working for more than 25 years. We asked more than ten Millennial's to share their experiences and selected five to conduct an in-depth survey of their behaviors and thoughts.

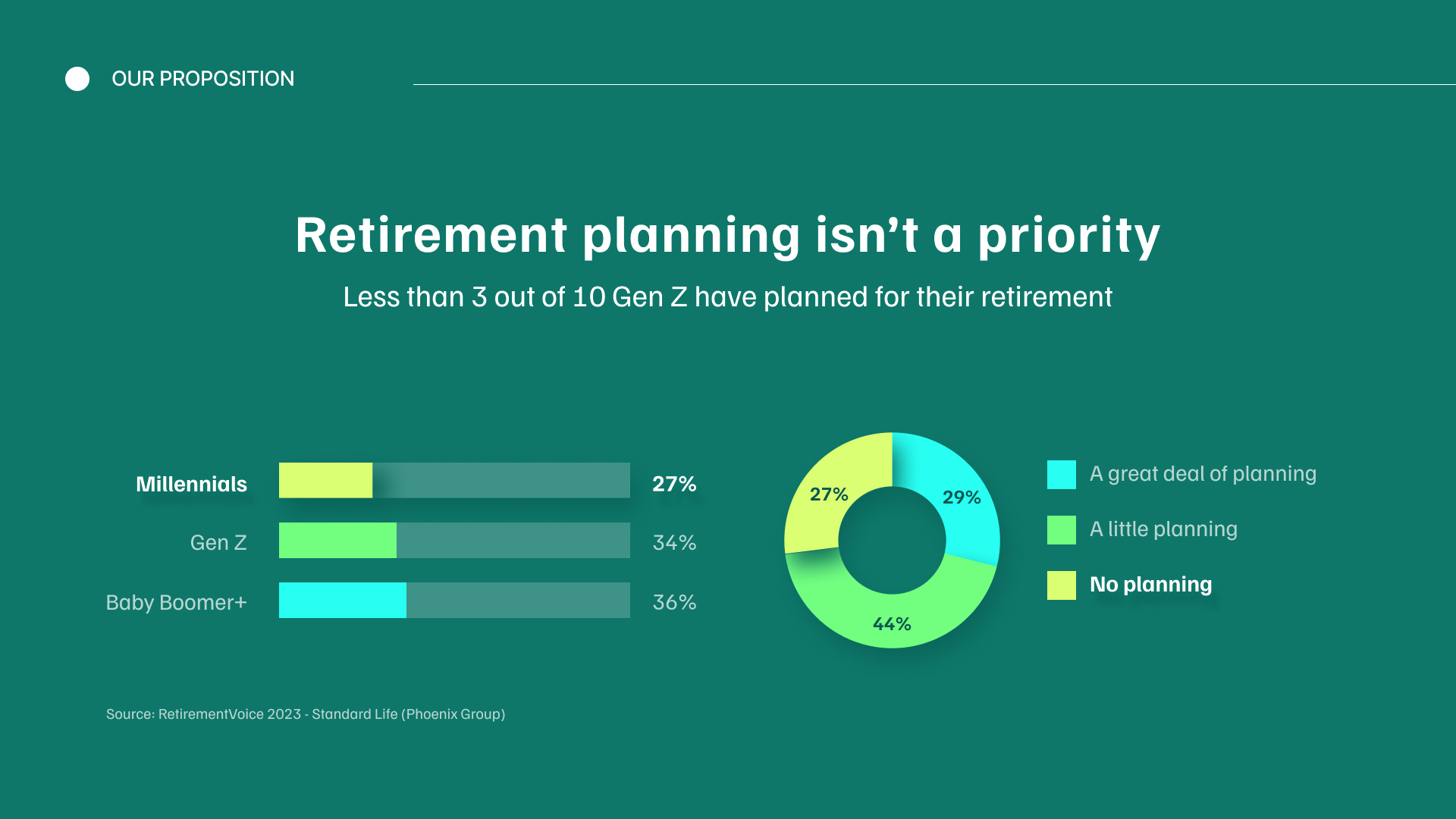

In summary, people are more tend to manage their finances in the present rather than contemplating retirement.

Persona

2. Define

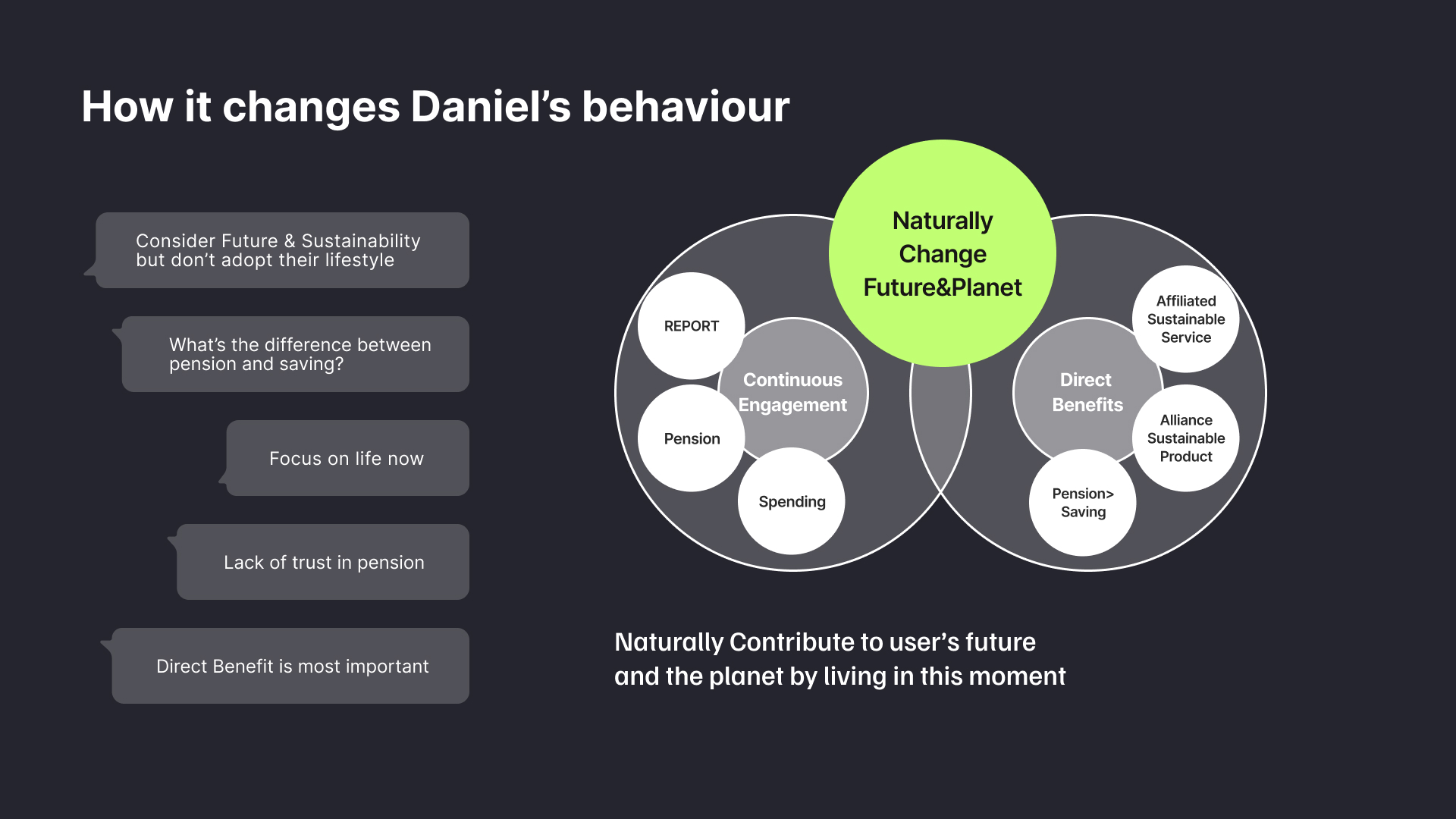

Approach investment

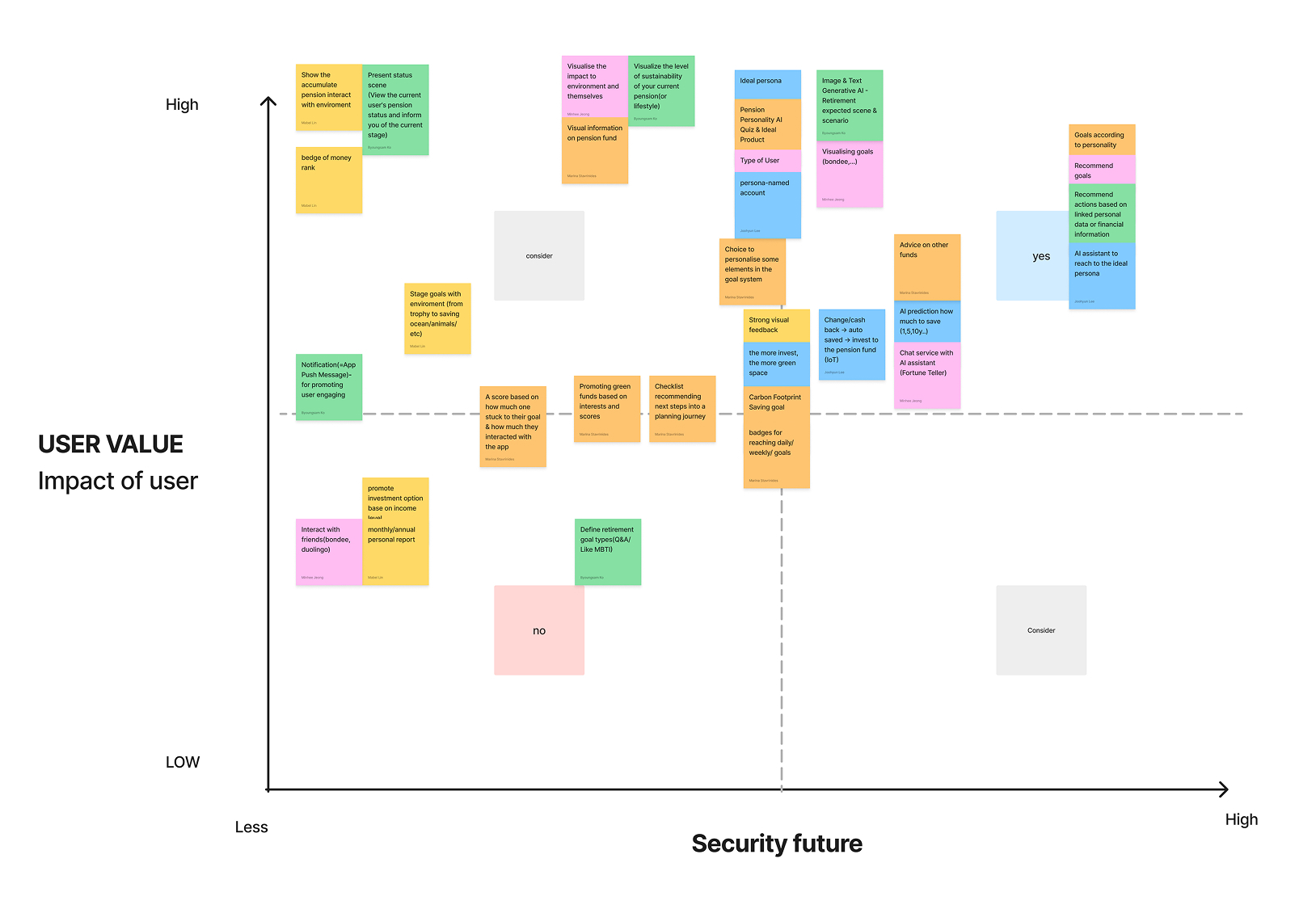

After having the above survey data, we started brainstorming, collecting everyone’s opinions, rating the value to users and the sense of security in the future, and filtered out the solution that best suited both.

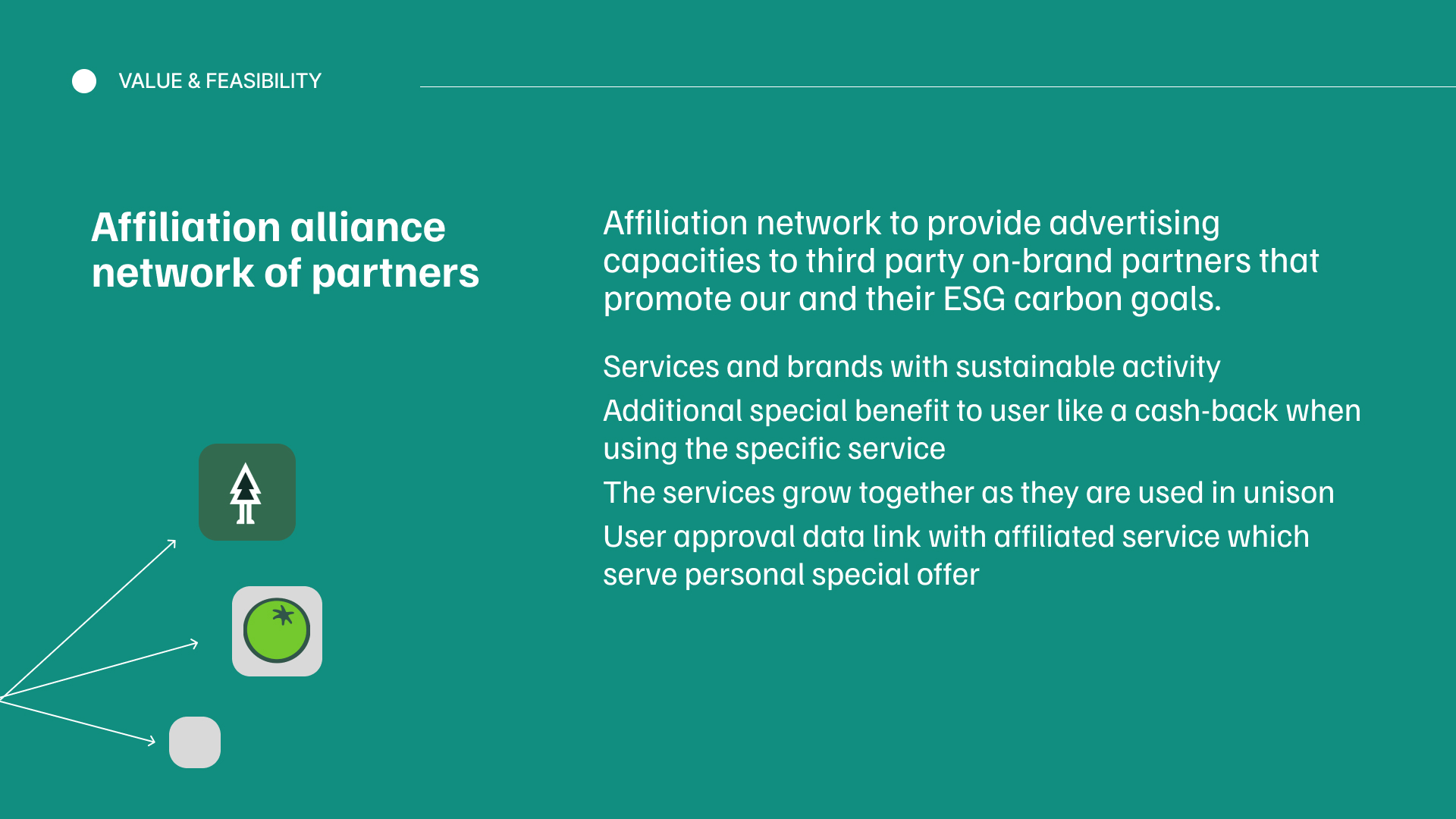

After screening, we will bring the selected solutions into the design thinking model to look for the desirability, feasibility and feasibility from the customer’s perspective, and balance these three to find innovative methods.

3. Design & Deliver

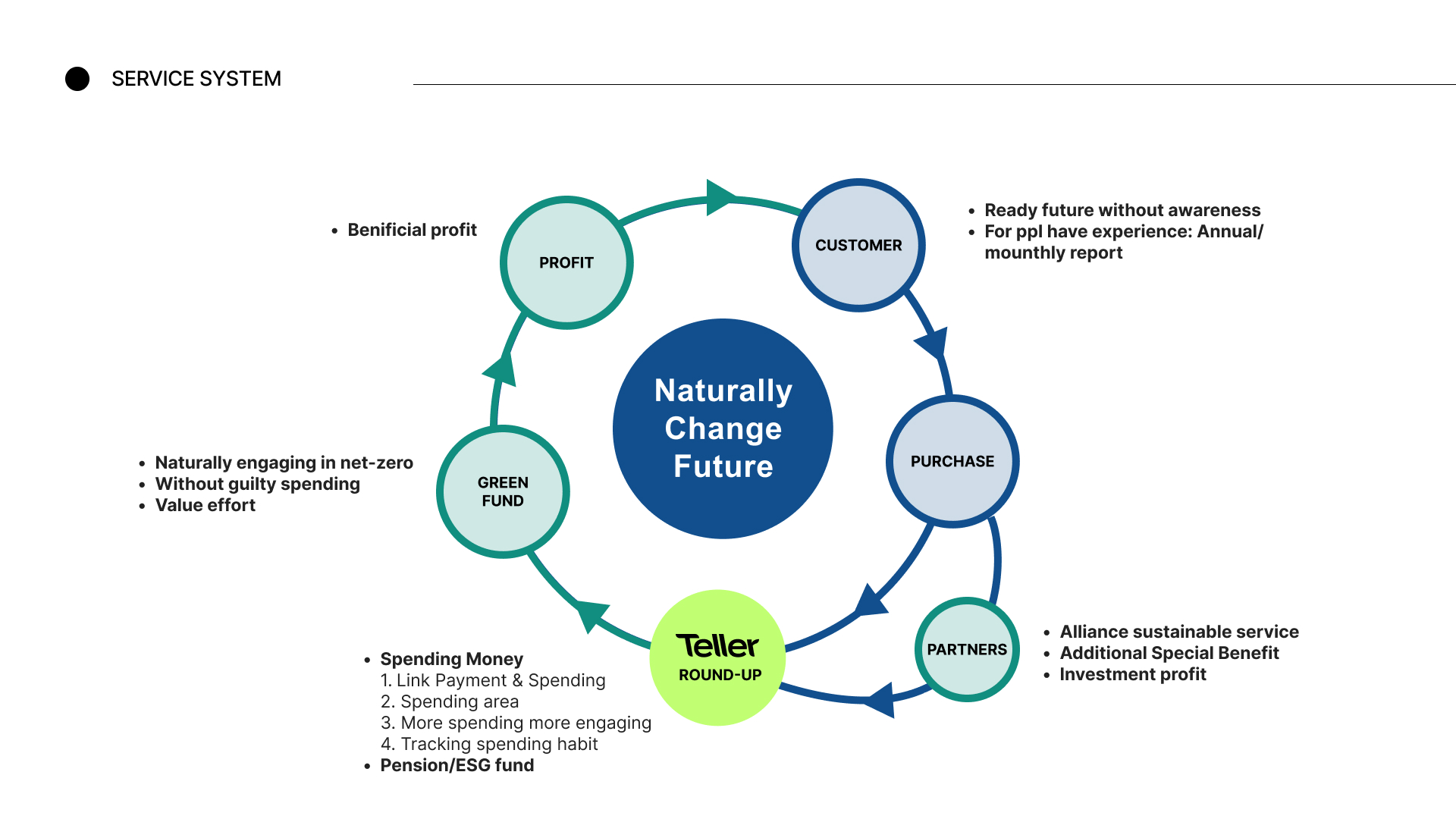

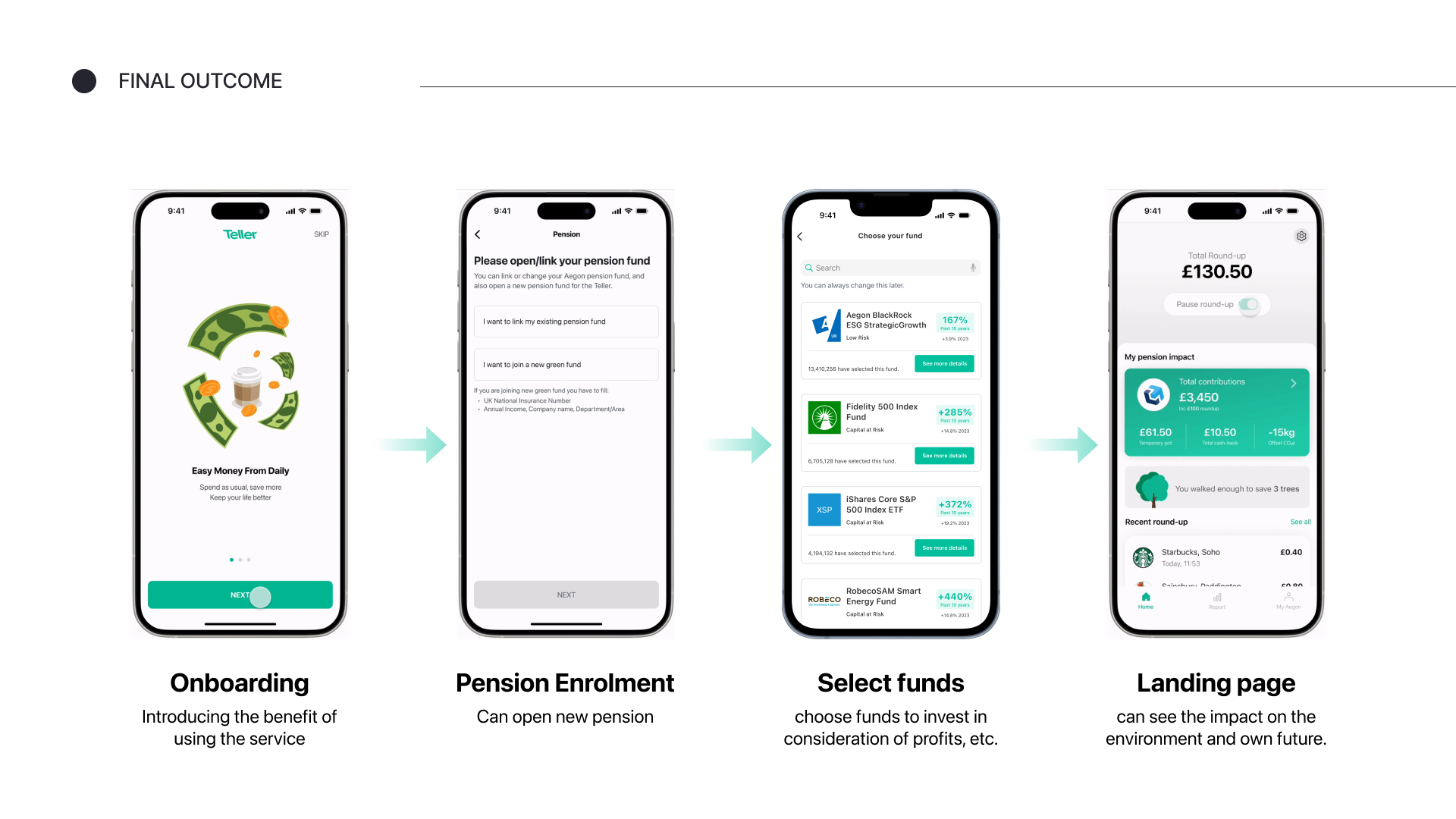

Our product is called Teller, and the idea is that we can help users map their future by taking control of their retirement savings and investments.

Our Service Process

Teller uses Round-up to allow consumers to round up the payment price difference when consuming and put the price difference into their pension account. For example, if a consumer buys a cup of coffee for £2.5, the payment will be £3, and the extra £0.5 will be Put it into your retirement account as a pension.

We limit this function to only stores that are beneficial to climate change. By continuously purchasing green products from such stores or investing in them, we will gradually build an image of a green future, giving them confidence in the future.

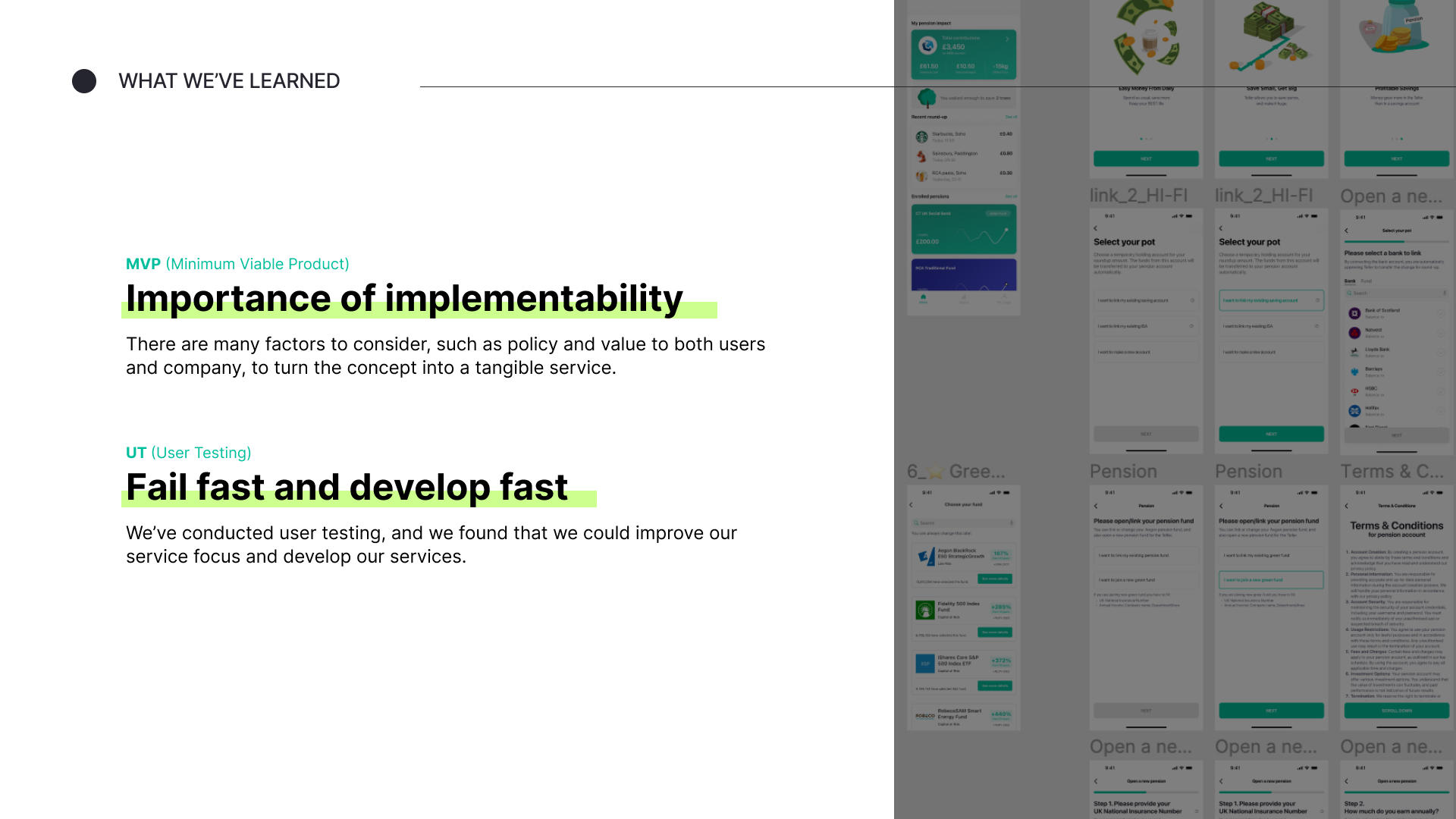

Prototype

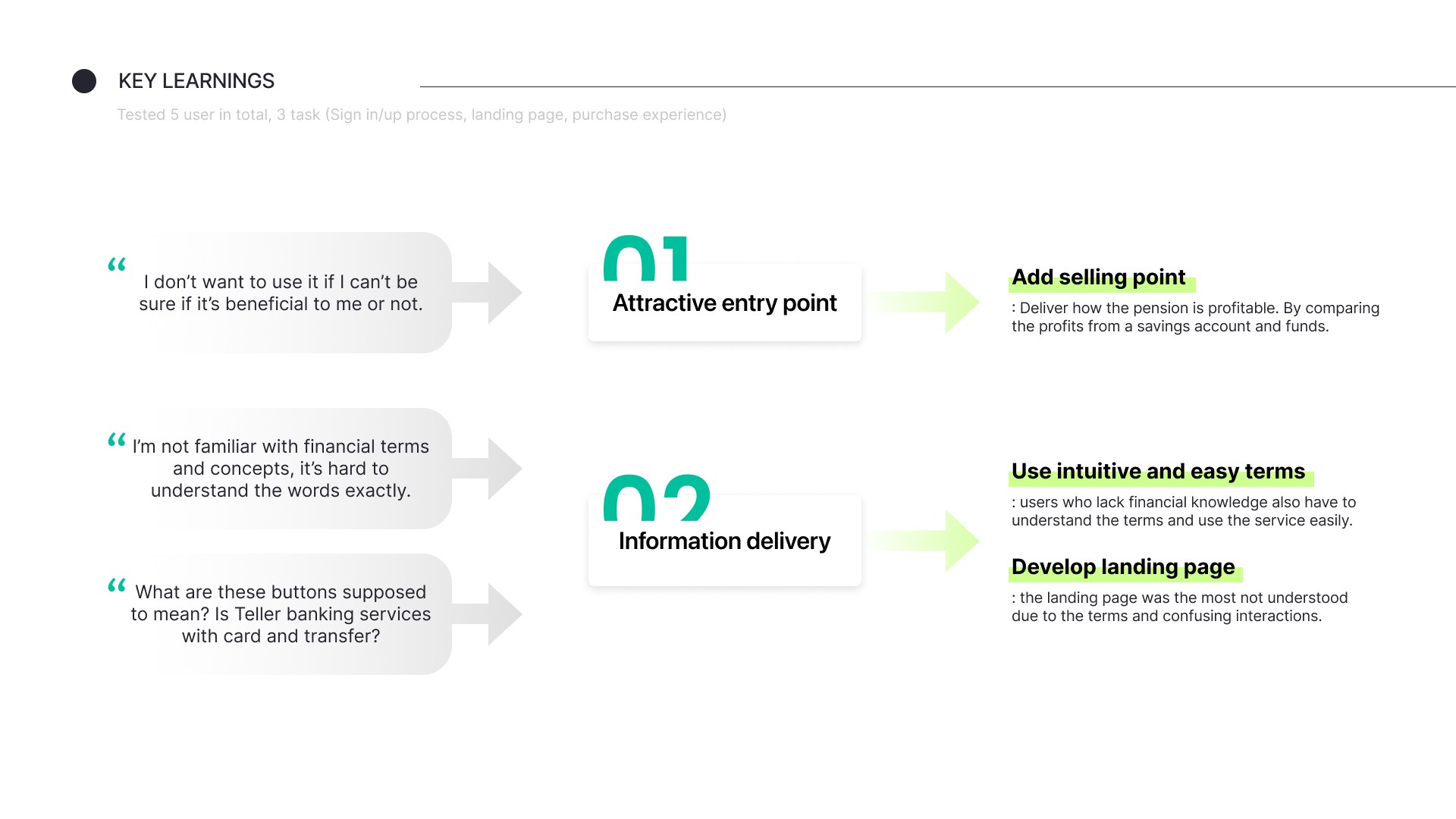

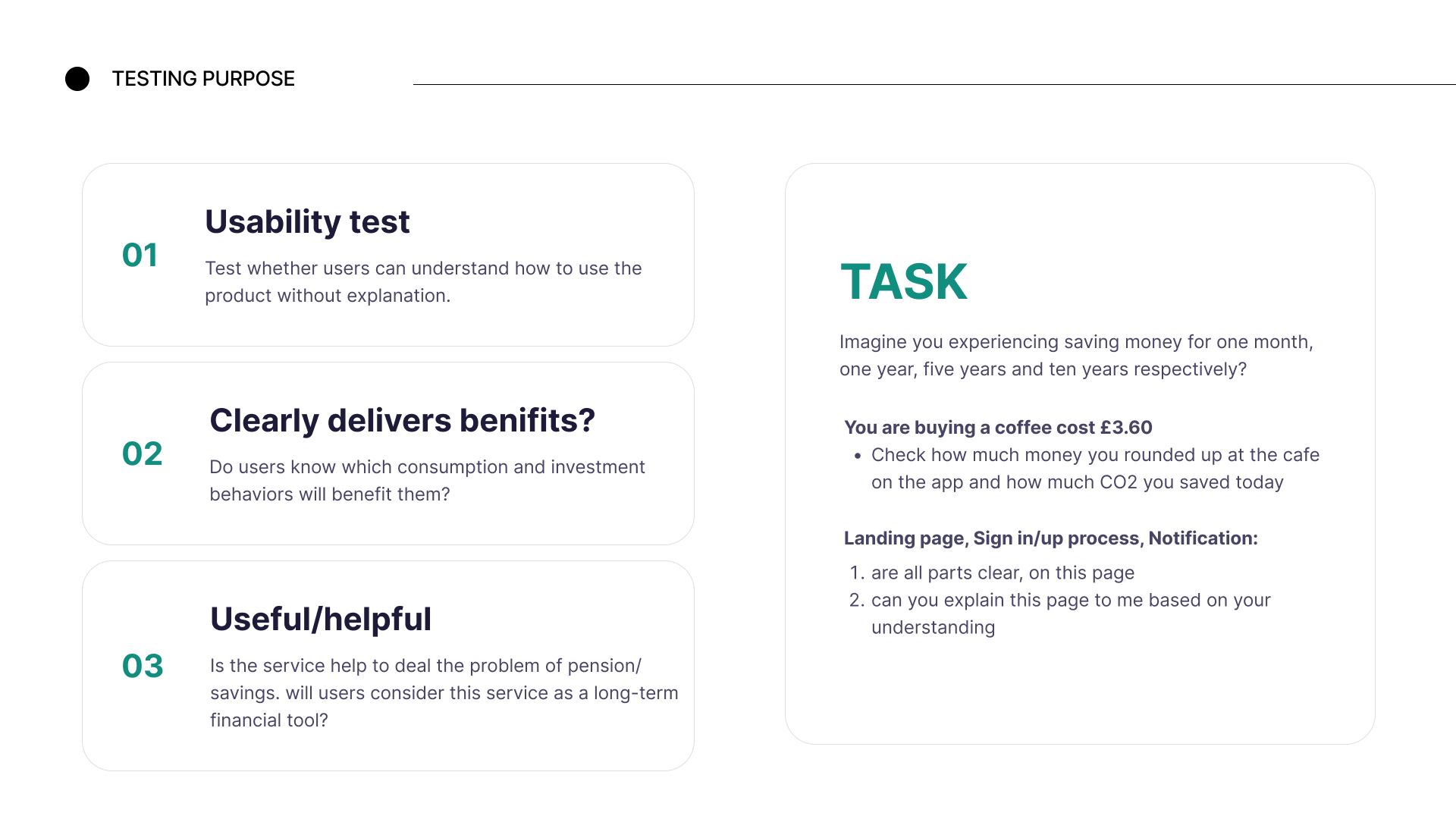

User and target testing

After entering the test, we listed several goals to measure our success. From the user test, we will see whether our service is easy to use, easy to use or easy to understand, and use the results to improve our content and finally we also hope to measure the feasibility of our services through competitive product analysis.

However, our testing time was less than a week, and we could only draw out the cocoons from a few samples. There were very few projects that could be achieved, which meant that there was a lot of room for optimization.

4. Conclusion

This project allowed us to fully experience the service design process. They all have rich work experience and their cooperation focuses more on practicality and rationality.

I was very impressed by their ability to process data and reconcile differences during the process. I learned a lot of skills in working with the design team from them. We often asked during discussions whether the argument was based on data or assumptions, and some team members also Always bring us back on track and pay attention to time control when we are diverging ideas.