SmartBeb - Actuarial your policy

💡 Introduction

SmartBeb aims to help people obtain insurance information online and the sence of trust to insure sales. A new insurance process will improve customer protection and business professionalism.

Certain data and research are hidden due to confidentiality agreements

🗓️ Timeline

2019.4~2020.1

Release time of the official version

📍 Role

UX designer

UI designer

Graphic design

🤝 Collaberators

Ray Kuo (PM)

Gaga Wu (GUI designer)

Mike Hsu (Front-end Developer)

🏅 Achievement unlocked

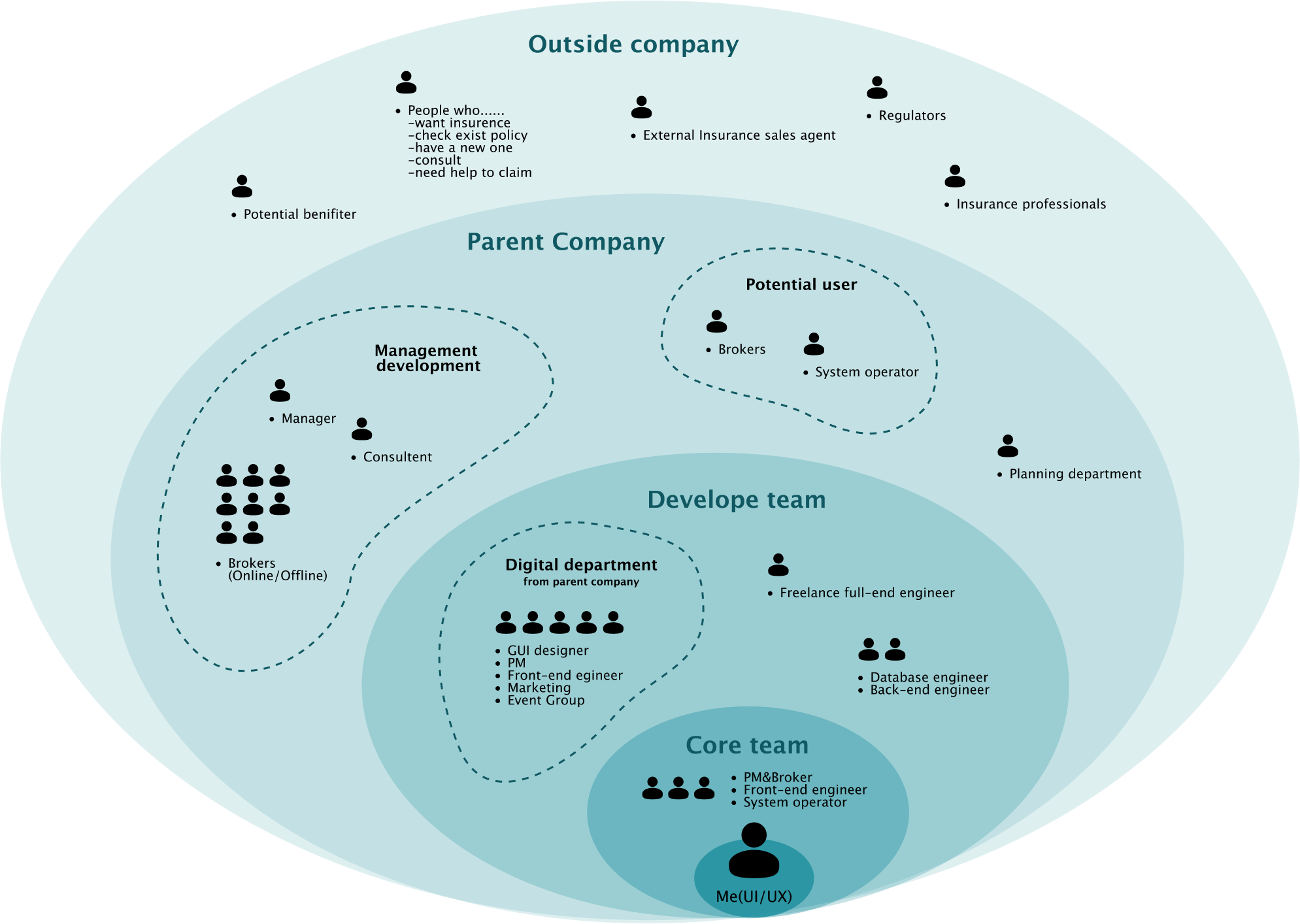

As the UI/UX designer in a startup under a parent company, I collaborated with internal teams (PMs, engineers, system operators) and external partners (investors, insurance brokers, outsourced vendors). I led the design of an insurance plan tool by aligning business needs, technical constraints and user workflows—ensuring it met both internal operational requirements and external user expectations.

0.My journey

1.Design Goals

- Build an end-to-end insurance planning and application experience.

- Facilitate effective interaction between brokers and clients.

- Create a scalable design system for future product and feature growth.

- Simplified complex insurance content to be beginner-friendly.

SmartBeb tried to develop new insurance calculator tool for both costemors and solicitor on their existing website. It is a pre-strategy for digitalize insurance in the future.

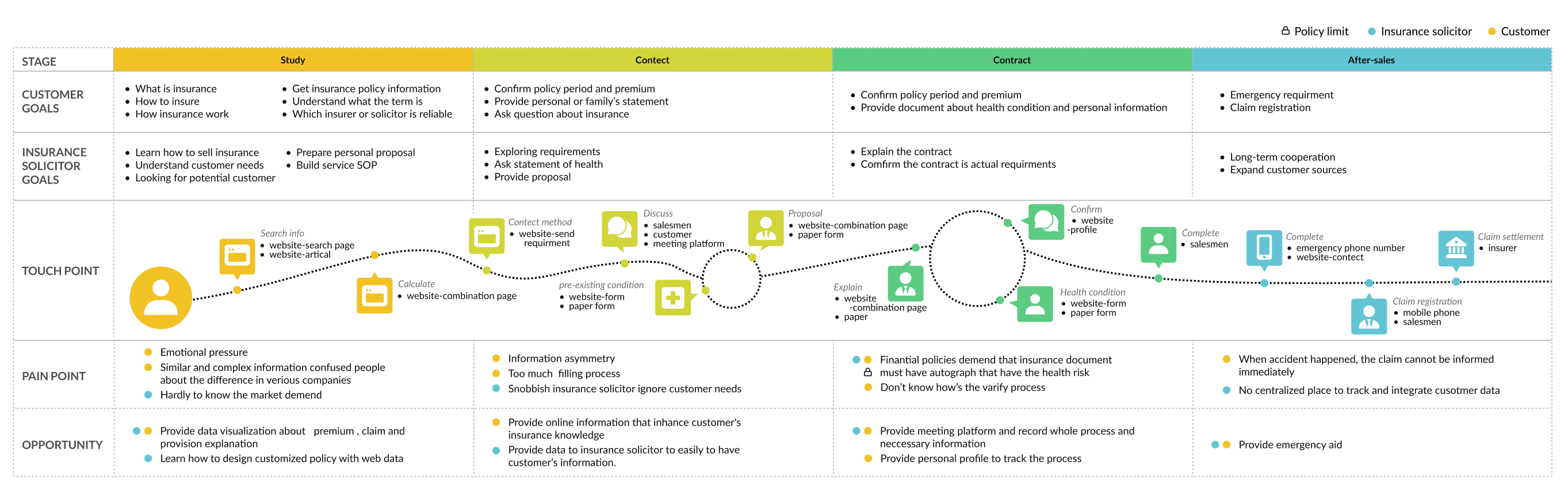

Identified Pain Points:

- Traditional insurance processes are vague and inefficient.

- Multiple user level (No relevant knowledge, few knowledge and professional) with conflicting needs.

- High compliance and data security requirements.

Tediously process (traditional offline insurance).

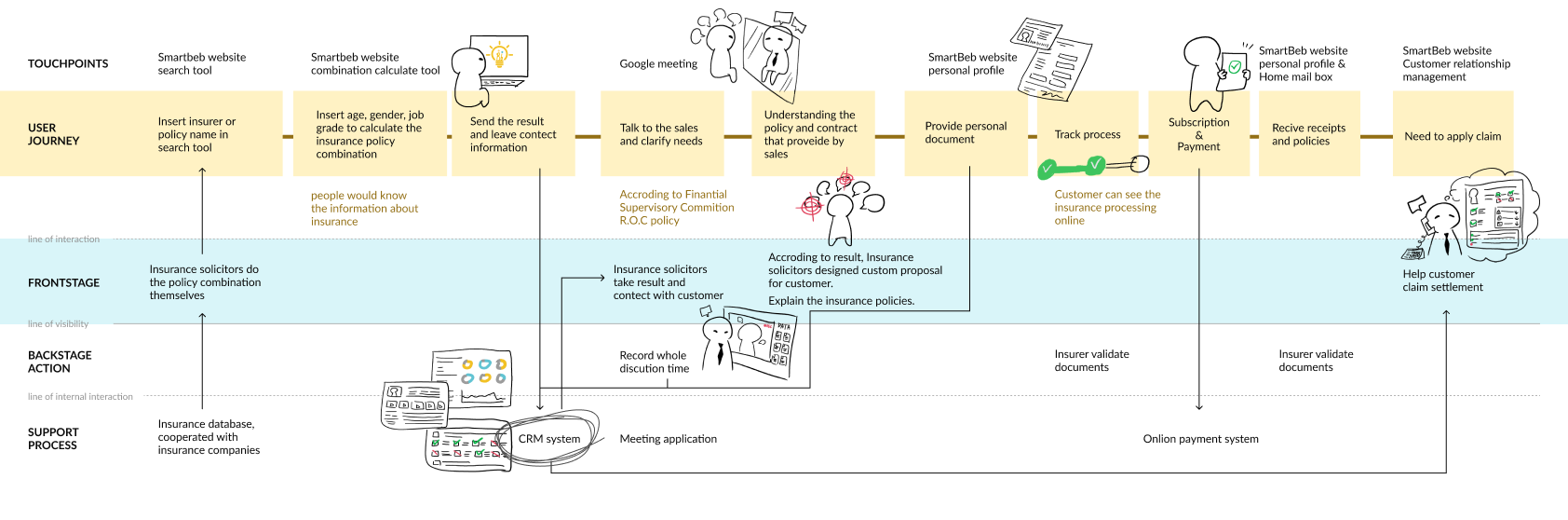

2.Stakeholder Integration Strategy

Stakeholder Map

Multiple target user

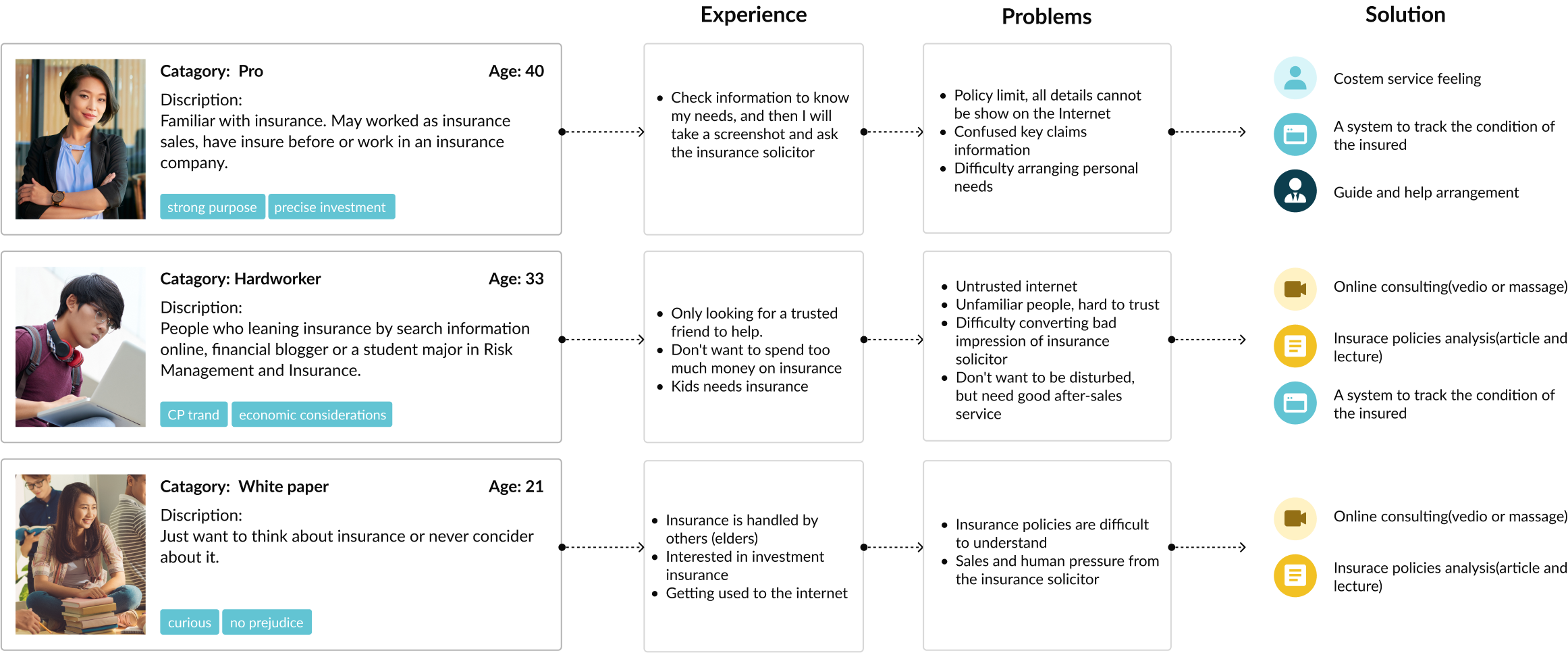

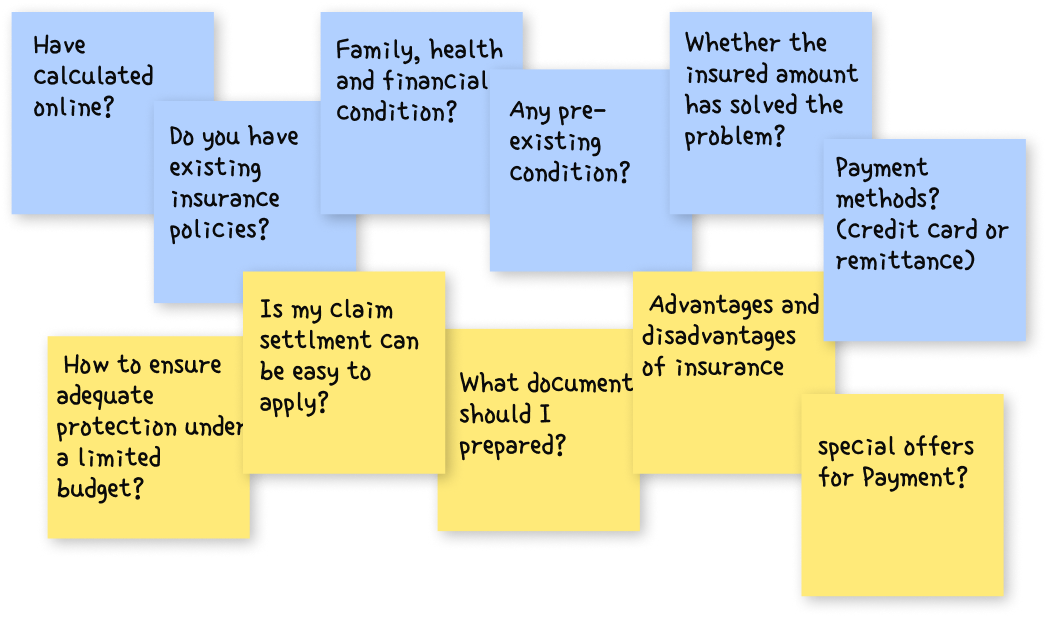

The initial target users were clients with no relevent or limited insurance knowledge, but the first actual users of the platform turned out to be the company’s insurance brokers. Therefore, I conducted separate analyses and created personas for users with different levels of knowledge.

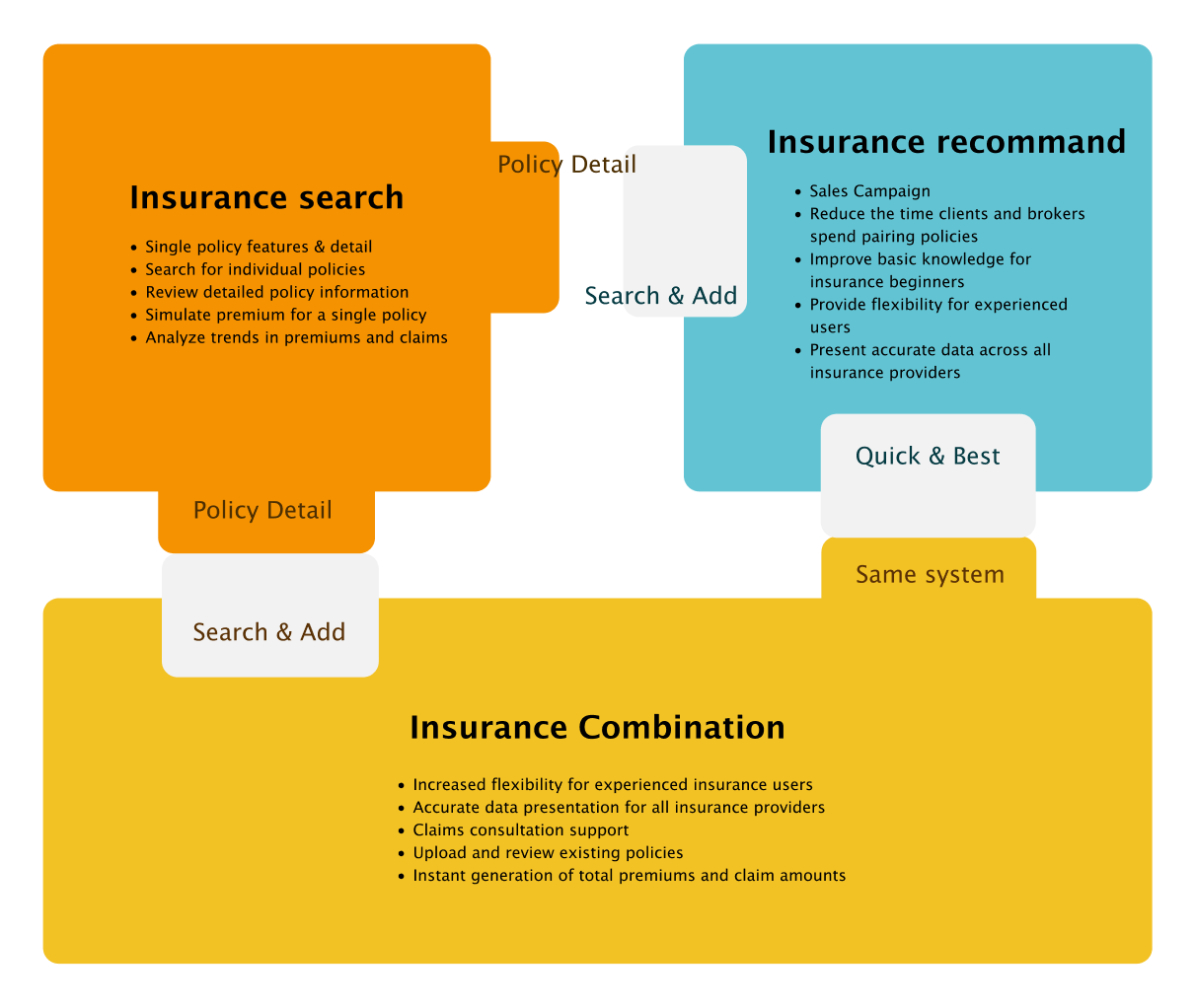

3.Scalable Design & System Thinking

Cross-functional collaboration

Three mainly tools

- Insurance recommendation - Mainly users are the general public. Recommend the policy combinations that have been formed on the website.

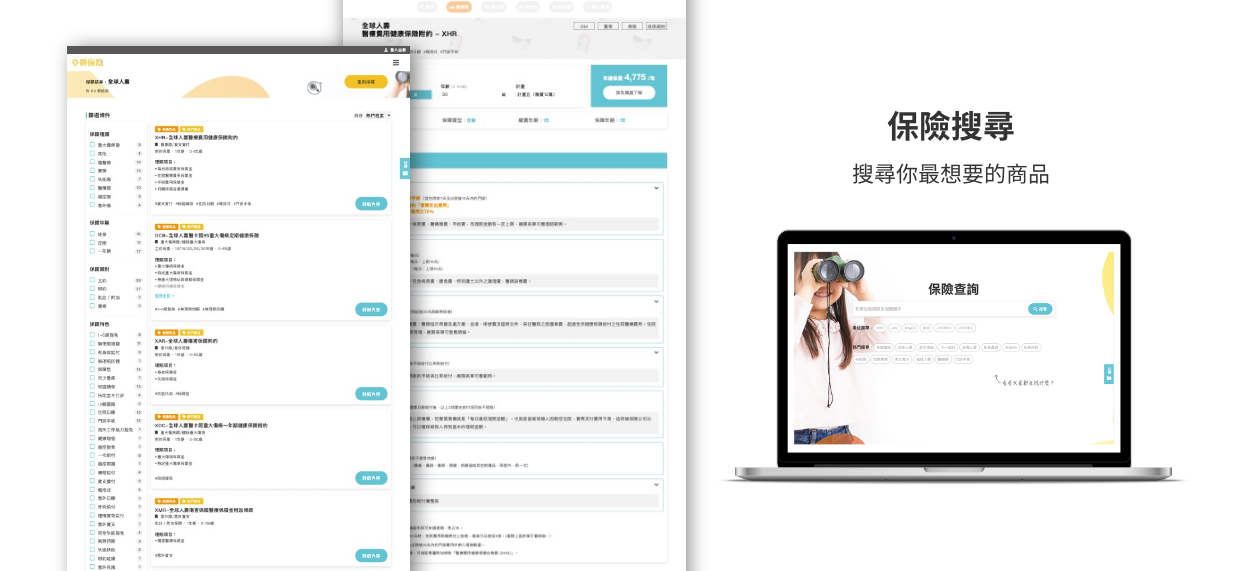

- Searcher - Search all policies currently on file on the site.

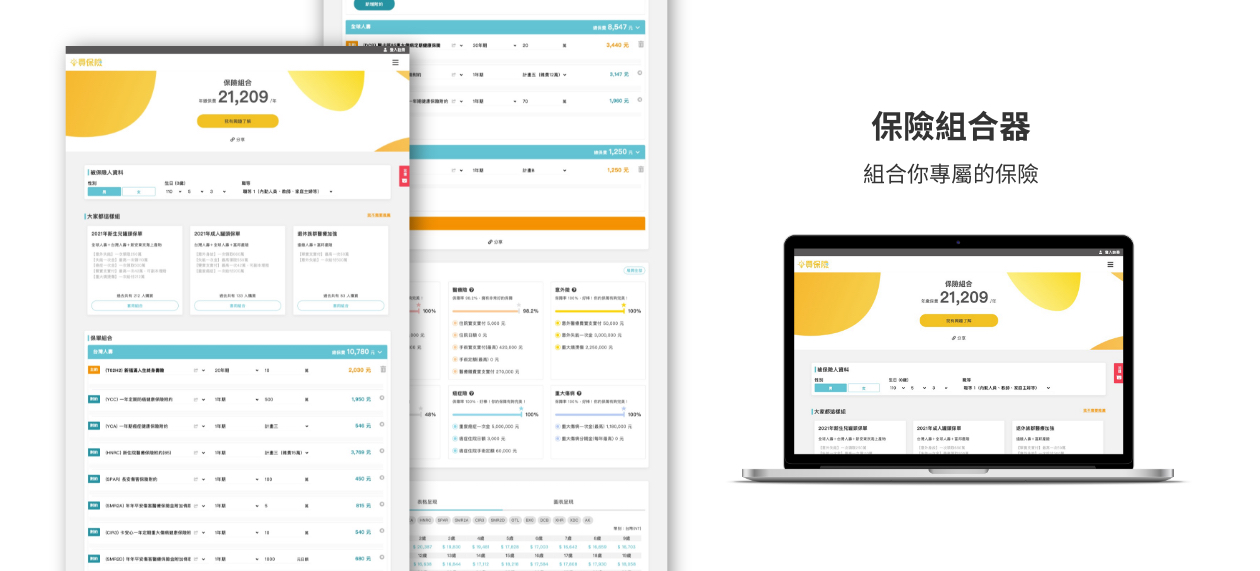

- Insurance combination - Mainly users are insurance solictors. It is the function of freely combining insurance policies.

The three tools will connect to each other and assist insurance solictors in the business process.

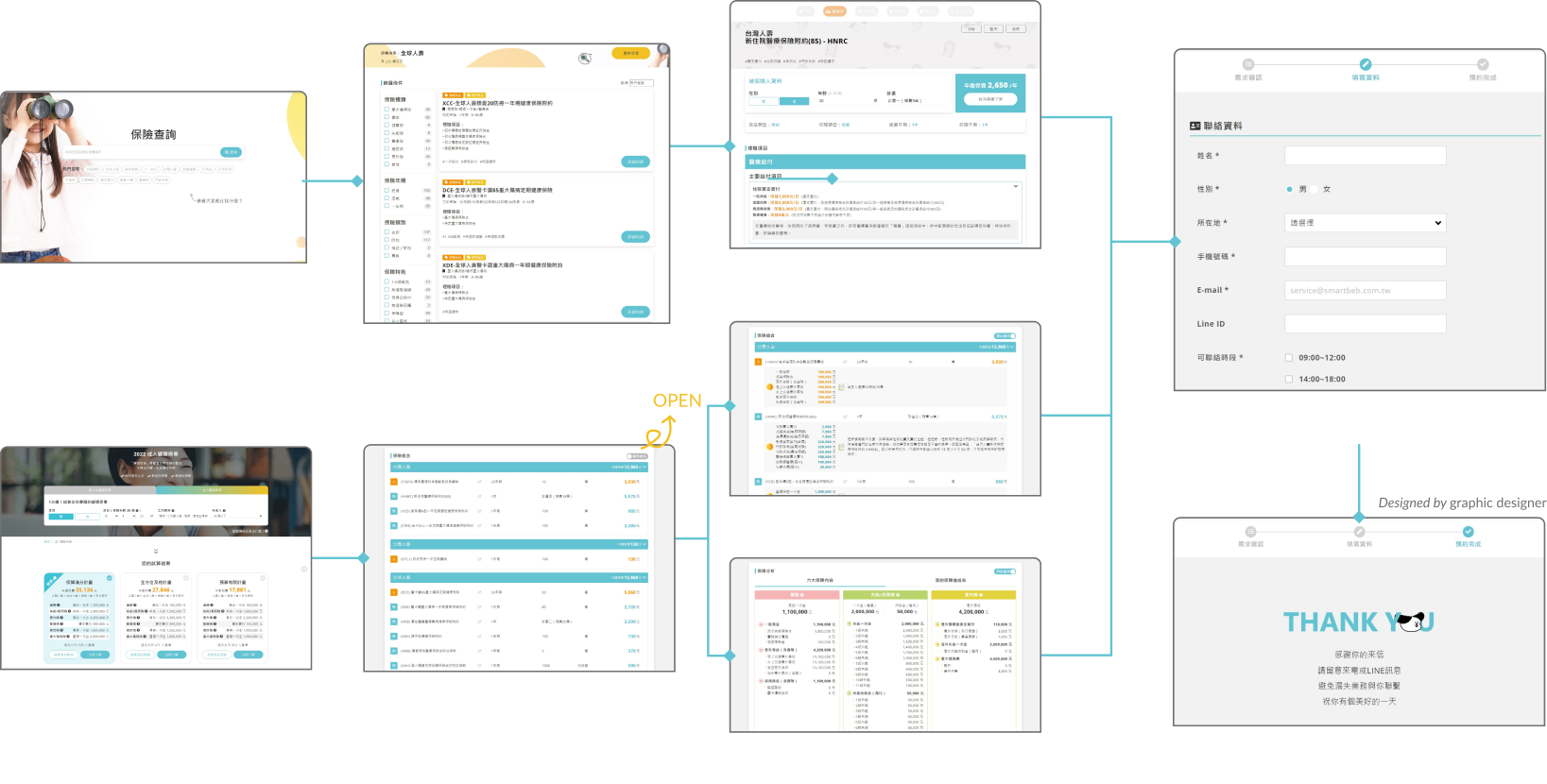

website Interface

Complex Multi-Role Experience Design

Policy restrictions

The platform is limited to providing matching and connection services; it is not permitted to conduct direct sales, sign contracts, or offer any incentive-based rewards.

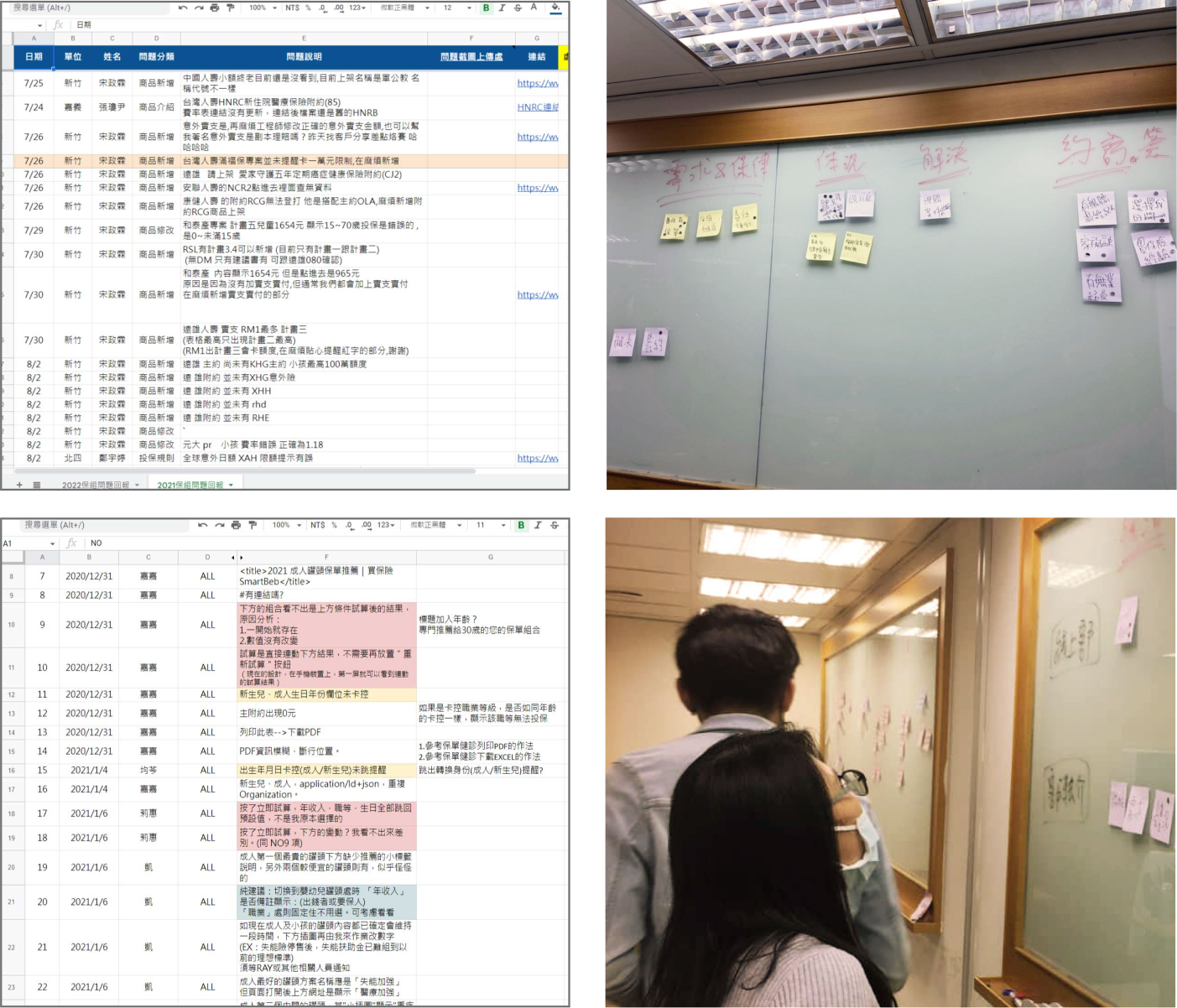

4.Usability Testing

A/B testing

We conducted testing and validation on both the business strategy and user behavior, exploring whether users needed the option to create custom policy package and evaluating the effectiveness of promoting pre-packaged insurance plans as a business approach.

8 Insurance solictors test record

We conducted internal tests with insurance solicitors to gather real user data and identify pain points. A/B testing on the website helped us understand customer behavior and optimize the experience. When database issues disrupted the flow or conflicted with financial regulations, we consulted financial experts to clarify processes and ensure compliance. Our goal was to align the product with their workflow and support customer analysis effectively.

Workshop

5.Outcome & Impact

Brokers can access and promote their own insurance packages, while clients can input their existing policies for review existing insurance or explore new one for purchase.

Insurance Recommend Page

Configured by insurance solictors. Users can calculate their own expenses in the combined insurance policy by inputting their personal conditions. The recommendation is eazy used, which are usually the most popular combination on the market.

-

White paper

-

Hardworker

Search Page

Users can search for policies. Would learn about versions of latest or previous policies.

-

White paper

-

Hardworker

-

Pro

Combination set Page

Not only providing a combination of your own insurance, but also provides a ratio analysis of insurance types, a list of claim items and year-by-year premium tables and charts for reference. For Pro person use, these insurance knowledge experts can make a customized place to do their own insurance policies. Each insurance product item can also be linked to its individual information page.

-

Pro

This is the outpost function of an electronic insurance policy. The company wants to develop the insurance business into efficient professional risk management experts, not just the business of selling insurance. I have been away from this company for a long time. Looking at the current website is a little different from the original plan, but the concept is still there. This is a very good experience for me, which benefits me to gain a lot in the complex financial field.

Expend features for different needs

- Retire

- Buy a house

- Parenting

- Start a business

- Marry

- Single plan