CraftMind

💡 Introduction

This is a Independent Research Project in Royal College of Art Service Design MA. Aiming to learning whole system design during master programme.

🗓️ Timeline

2024.04~2024.07

📍 Role

Service designer

Graphic design

🏅 Achievement unlocked

The biggest challenge was to create an anti-fraud service that fits the lifestyle of the locals in a place I was unfamiliar with in only four months. In the early stages, I spent a significant time researching various media, including papers, articles, policies, news, movies/videos, books, forum, psychology, interviews and personal experiences (of course, they failed fraud) just to find the most critical problem. Ultimately, I came to leveraging people’s attention cycles to trigger their sensitivity and awareness during specific periods.

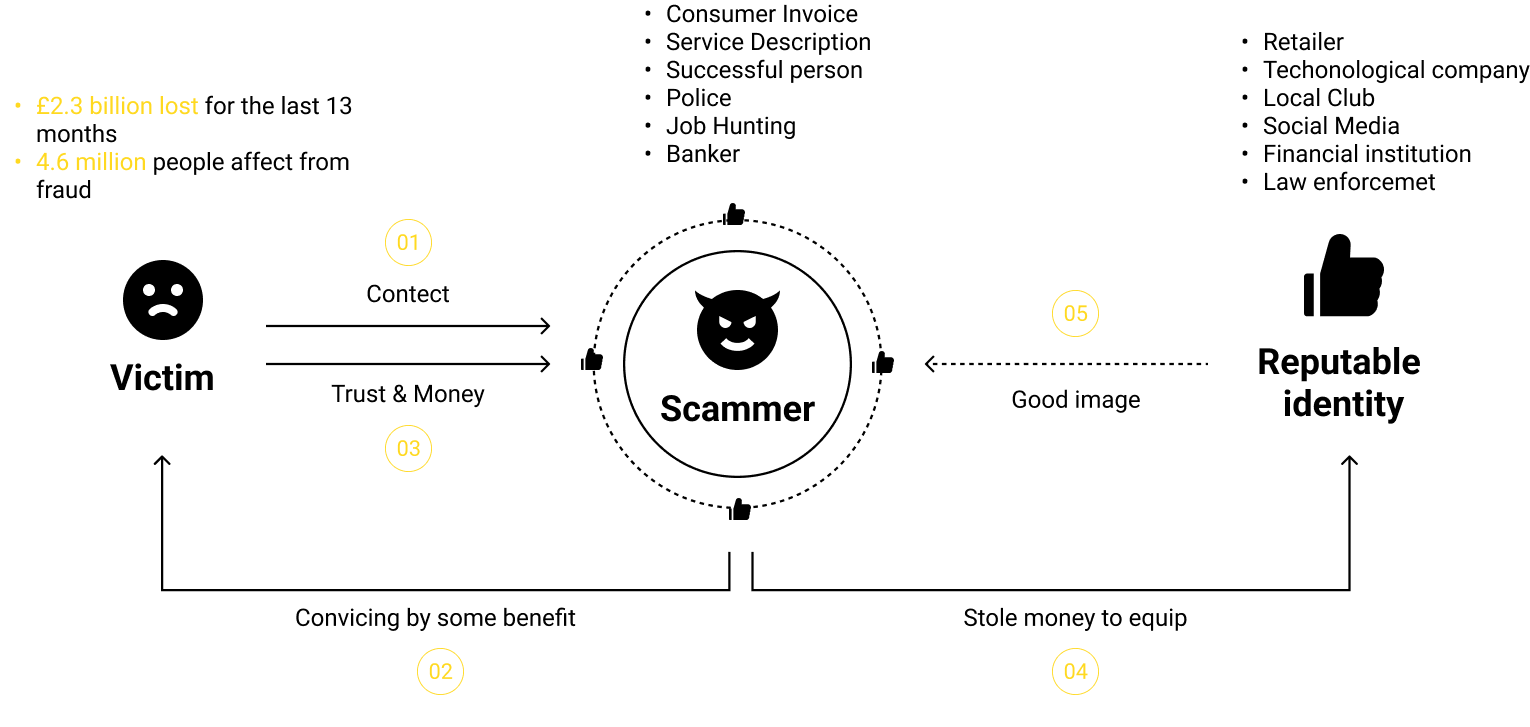

Background

Fraud is a serious problem in the UK and all around the world. According to BDO’s investigation and Fraud and Cyber Crime report, a total of £2.3 billion was lost to fraud in the past 13 months. More than 70% are fraud traps that lead to information theft. These horrific figures account for less than one-seventh of the total, representing many more potential victims.

How's the fraud happen?

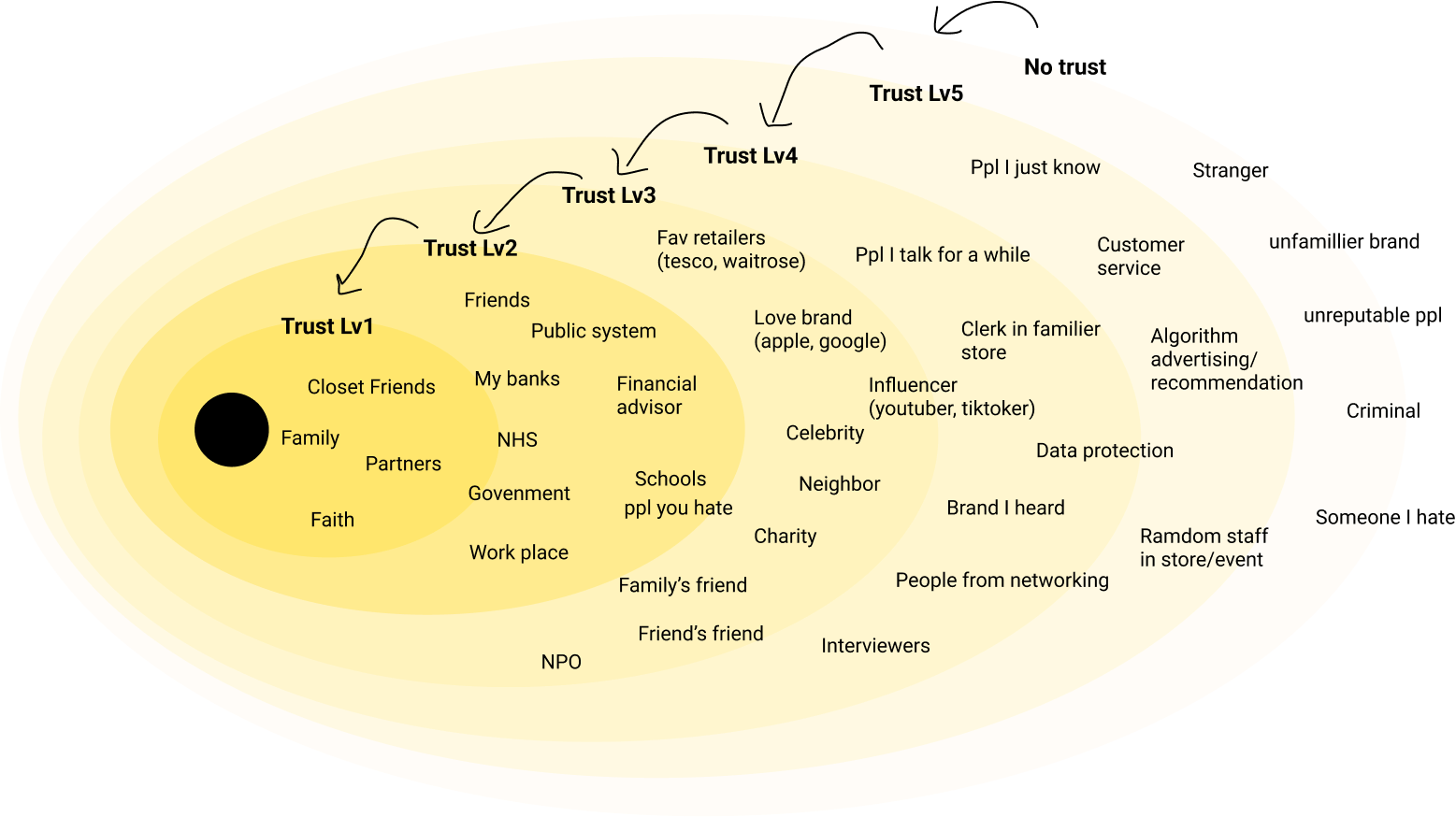

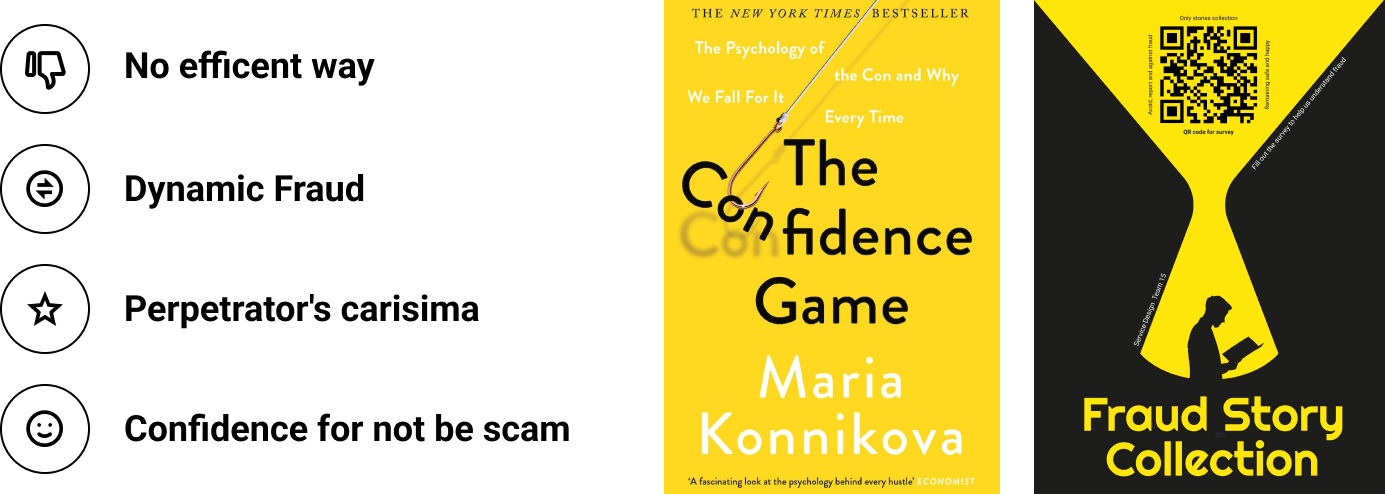

Fraud is the crisis of trust. Scammers use this trust to make promises, and once they gain access to a person’s property, they disappear. Modern fraud techniques are becoming complicated, but they still fundamentally rely on building a reputable image to win trust. Scammers might pretend as your financial advisor, spiritual guide, or a prospective employer. They invade people's life by using their desires and aspirations.

How do I conclude fraud pattern by research? Check Medium

Prevention

People Trust Level

Why being scammed?

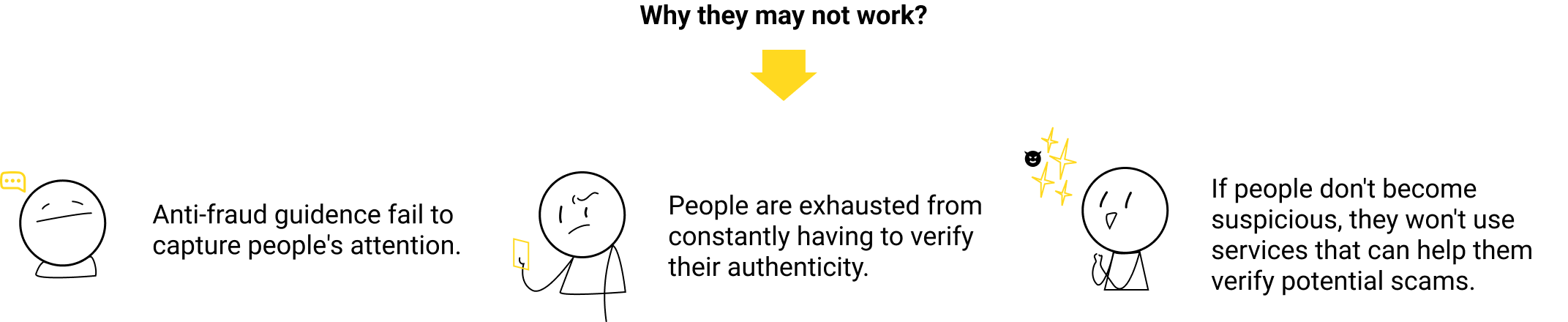

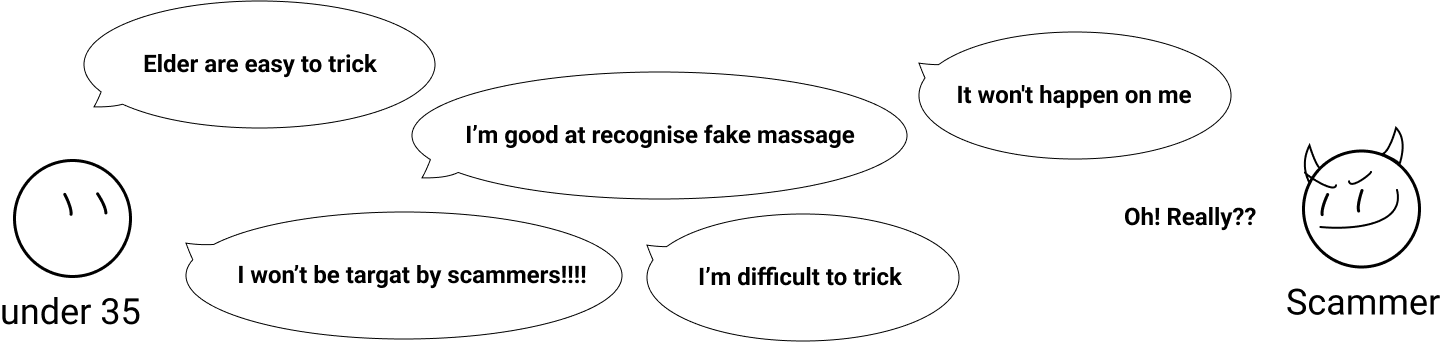

Through desk research and collecting stories from individuals, I found that educating people to prevent fraud has limited effectiveness because scams are highly customized and we can’t make people always suspect others. Many people believe that falling victim only affects the elderly. In reality, people under 35 have five times more risk than people over 55. Because of their overconfidence and the strong belief that they won’t be targeted by scammers.

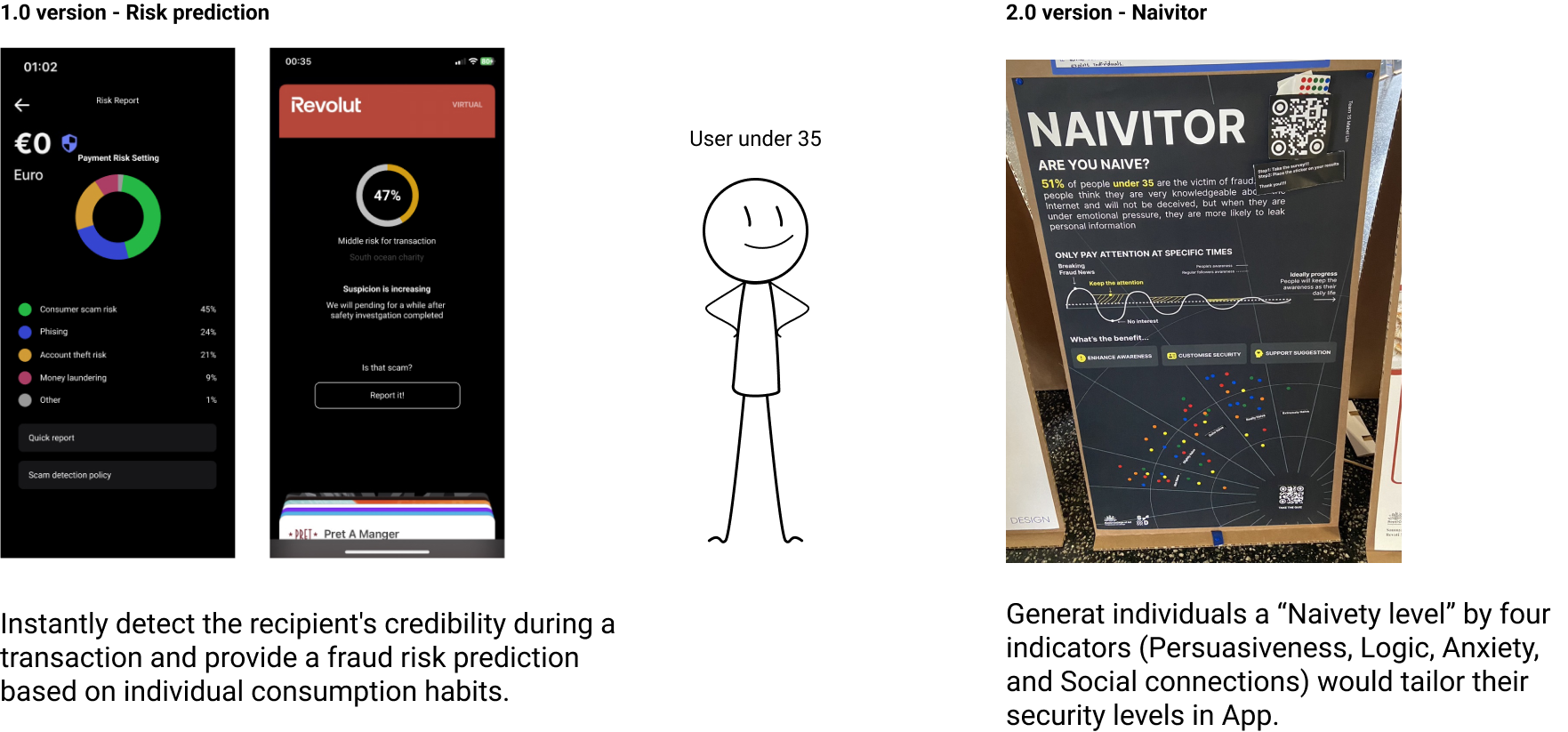

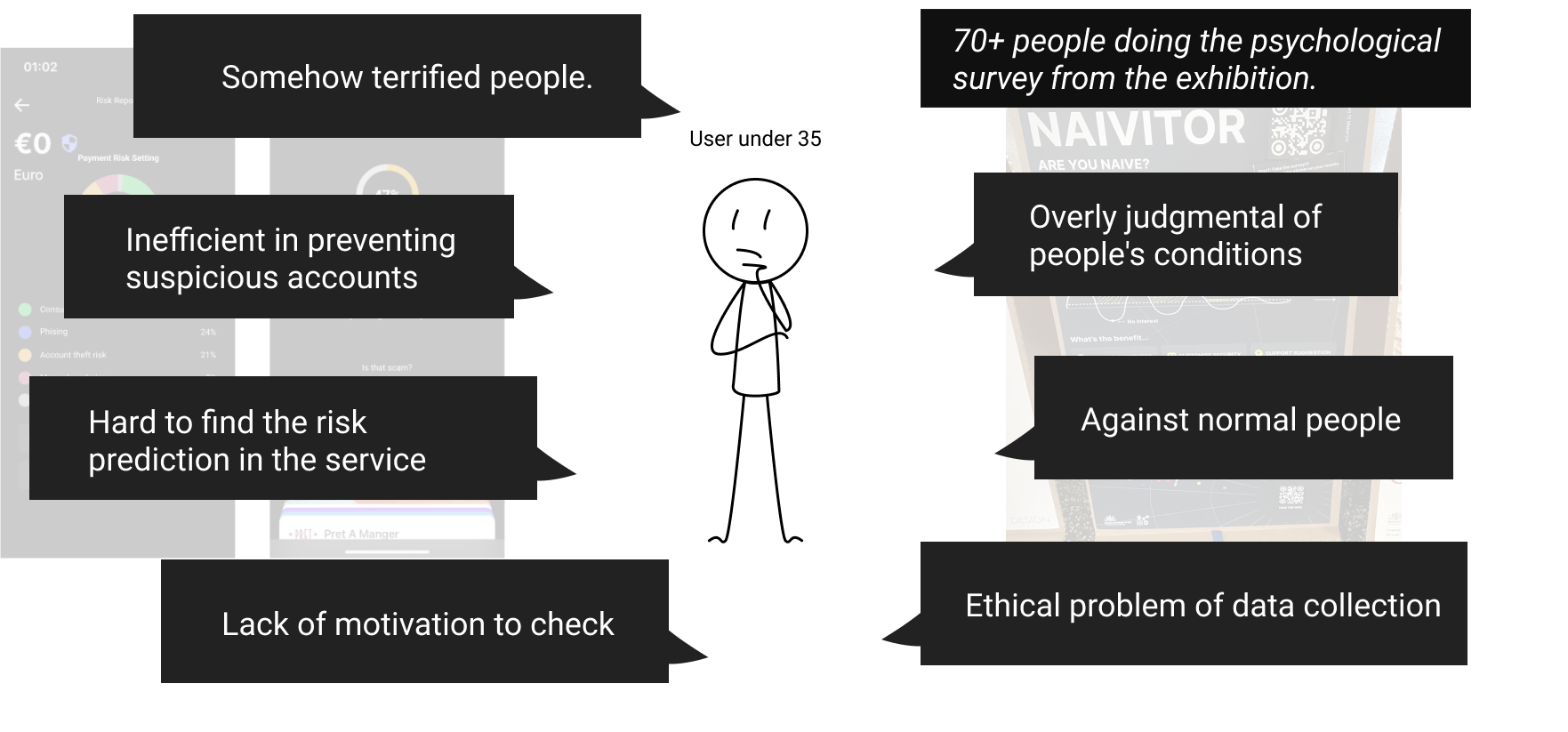

Prototype

I developed two prototypes to test people's feelings of risk. The first version is a risk prediction tool designed to detect the credibility of money recipients and provide timely alerts. It shows potential fraud types they may encounter based on users' consumption habits in their bank accounts. The second version, named Naivitor, generates a naivety level by evaluating indicators such as persuasiveness, logic, anxiety, and social connection. This score helps to tailor a user's security level and adjust it over time.

The result in the risk prediction, people expressed that consumption warnings might be useful but they were concerned about whether they had made a mistake to deserve this and they lacked motivation to check the prediction. As for the feedback on Naivitor, users found questions linking real-life is easy to engage in and dynamic verification questions will reduce the burden of transactions. But they worry about the over-judgment of people and about giving too many rights for service providers to control their lives.

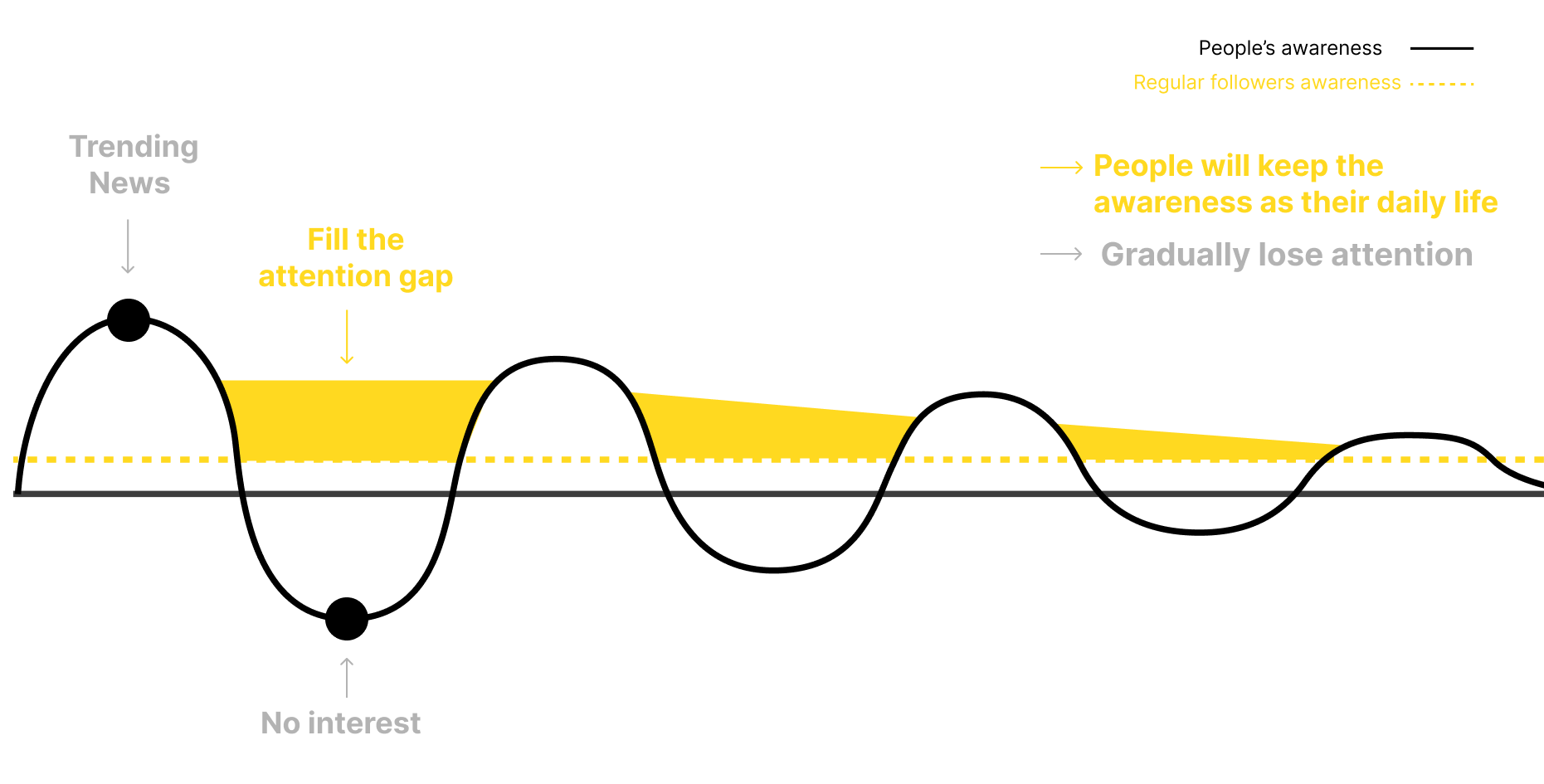

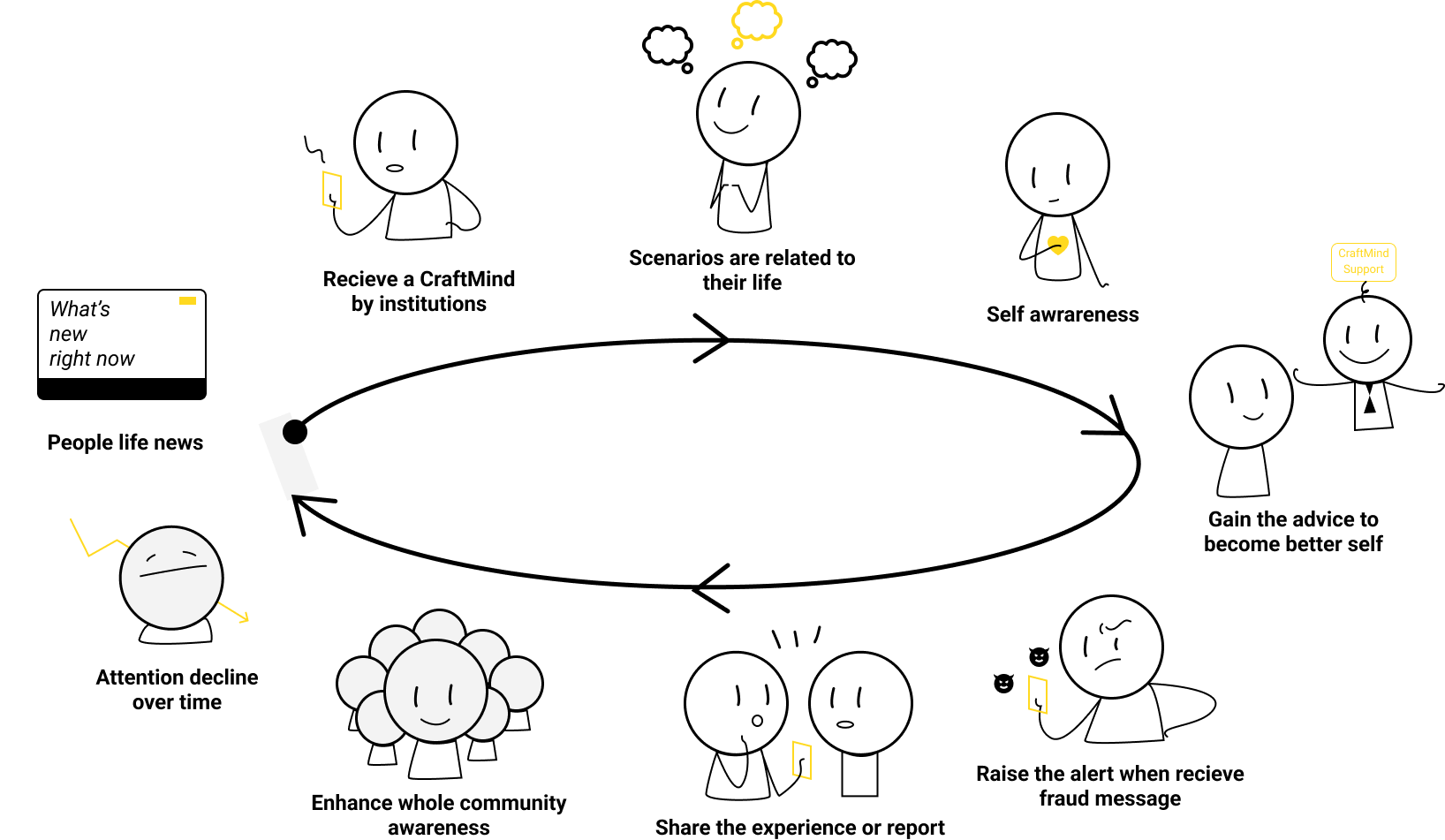

Attention curve

During testing and data collection, I discovered that people's attention to events like this curve. When individuals receive new information, their attention is initially high, after some times, it becomes difficult for them to maintain attention and they lose interest. However, there is a group of people, represented by the yellow dashed line, who may not have high attention but consistently make an effort to keep themselves and others pay attention.

Solution Summary

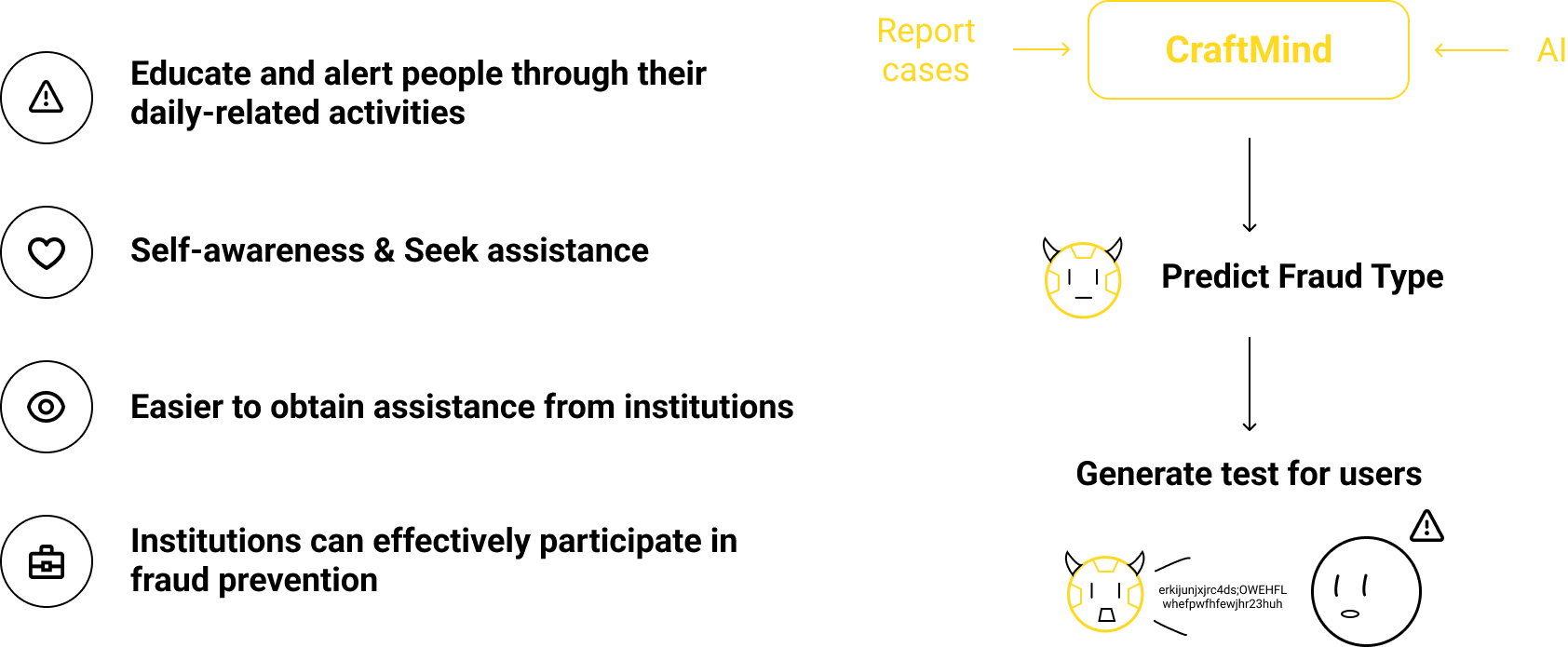

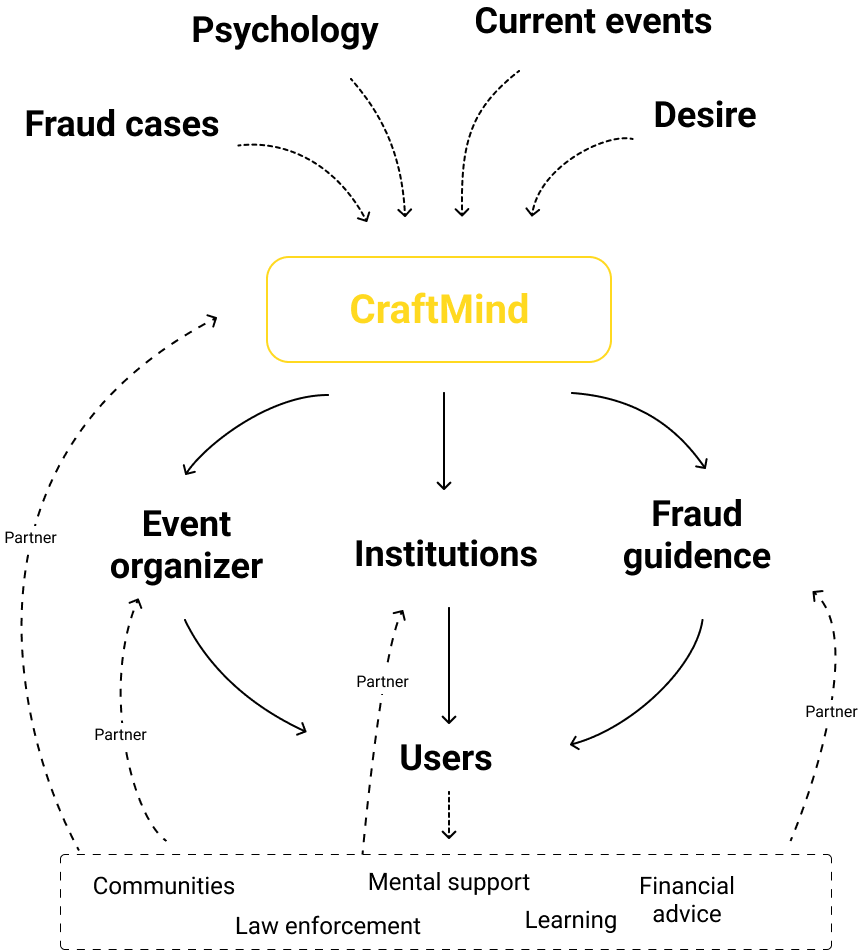

CraftMind is a micro service that uses scenario questions to educate people about the risk of fraud.

- How

The service includes setting up different types of fraud, current event article, psychological questions and the behaviour of people.

- When

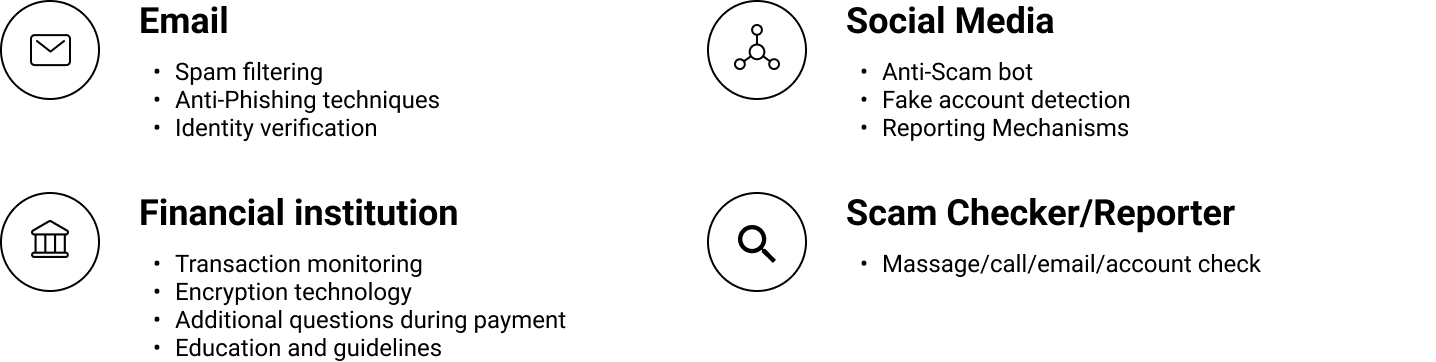

CraftMind can be intevene into service and event, allowing companies define how CraftMind will present. They can use it to send out their anti-fraud guidence, notifications, and advertisements.

- What

Focus on guiding people to recognize their current state through their daily behaviors and actively seek assistance from relevant partner organizations.

User Journey

As people follow current events, they also receive tests from CraftMind. These tests are designed to be engaging and relevant to the things they are going to do. CM helps users better understand their current situation and connect them with partners for support. This allows individuals to recognize the fraudulent message. After that they share their experiences with friends and family. As time passes and interest declines, new current events will take place, creating a loop of vigilance.

Benefit & Future

It not only educates and alerts people through their daily activities, but also guides them to actively find support. It helps individuals improve their lives and mindset while making it easier to access and benefit from service providers. When institutions are aware of the situation, they can positively conduct anti-fraud events, using CraftMind for advertising, and helping people become stronger. In the future, if fraud patterns change, CM will leverage the data and AI learning to present predictive models directly to users against scams.